Well, here I am: head hanging in shame. I've blogged about this previously, but here I am with the real results of this spend-freely-forget-the-budget month.

Well, here I am: head hanging in shame. I've blogged about this previously, but here I am with the real results of this spend-freely-forget-the-budget month.

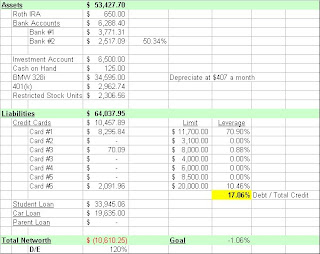

My networth dropped to -$10,610.25 from -$10,570.00. My networth is going backwards, and this is unacceptable.

My investment account is a little negative, but pretty close to about even, as the past two weeks of volatility has taken a toll.

I also spent today re-doing my budget. I started by adjusting my base salary, as I am expecting a 6-10% increase starting in July. I was very conservative, and only assumed a 5% increase. With the increase, I then adjusted up my gas, food, utility, and discretionary budgets while also ensuring I am saving $150 a month more than before, if I stick to my budget.

This is going to be gradual climb back to fiduciary responsibility. Stay tuned.

| |