This will be great for US' global standings and the US economy.

Already, Asian markets are reacting positively, and expect a 200-300 point gain from tonight's solid turnout for Obama.

I expect to see oil and gold fall, while the US Dollar should appreciate.

Wednesday, November 5, 2008

Obama Wins!

Posted by

Finance Guy

at

12:37 AM

2

comments

![]()

Monday, November 3, 2008

Networth Update

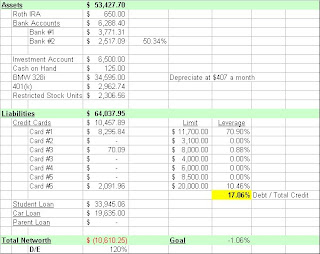

Not much to say. It's been a while since I got my networth together. The past two months of market turmoil has done little to help my networth. My investments and 401(k) have both taken significant hits. Thankfully, I'm young and I should recover quickly.

Not much to say. It's been a while since I got my networth together. The past two months of market turmoil has done little to help my networth. My investments and 401(k) have both taken significant hits. Thankfully, I'm young and I should recover quickly.

Total networth: -$16,474.33 putting my -1.65% from my goal.

Gotta stay on budget much better. It's tough.

Posted by

Finance Guy

at

9:40 PM

0

comments

![]()

Monday, October 27, 2008

What is the market waiting for?

With the prospect of more rate cuts on the horizon (realistically only 4 left before 0%), the market continued to seesaw, finally going red in the final hour of trading. However, the drop wasn't very significant. Such daily volatility resulting in so little real movement causes me to believe that we have a ways to go before we're out of this recession.

What I'm looking for is a good 700-800 point one-day drop, where from start to finish, the market was consistently in the red. This will be such a huge signal to everyone, that rich, nearly all cash position investors, will be forced to quickly and greedily invest.

Posted by

Finance Guy

at

8:34 PM

0

comments

![]()

Sunday, October 26, 2008

Last week

Economic fundamentals last week were being watched on the stock market for the first time in a long time. It has been a while since people considered earnings in watching the stock market, and I really think it's the beginning of the end of outright market pessimism.

Come on stock market, I'd like to see my 401(k) not end the year down 40%...

Posted by

Finance Guy

at

8:25 PM

0

comments

![]()

Saturday, October 11, 2008

Ugly Week for the Dow

What an ugly week for the Dow! -1875 pts representing -18.15%...

Spent the week at work analyzing companies, not dictated by my boss, but rather through minute to minute updates on MarketWatch and CNBC. Things were just happening so fast. There were some moments that on my 30 second walk to my boss' office, the news I was going to tell him had been changed and he about to come to tell me.

Just crazy.

But what now? With the bailout passed, money flooding the markets out of the coffers of many governments' central banks, and oil futures falling, global stock markets continue their death march. Every day they open is another 5% decrease in value. How sustainable is this?

Well, there is one number that they could end up at: 0.

Hopefully, this weekend's emergency meetings between finance ministers will result in a positive AND cohesive message. This was attempted this Friday and ended in a dismal message: "We know we need to do something, but we can't agree on what."

The way I see it now, the markets are falling due to mass chaos and fear. Perhaps the best way to calm these fears would be to shut down stock markets for a few days and allow companies to start worrying about running their business, rather than having their CEOs mesmerized at their desks, tapping at the ticker symbol as it scrolls by.

Posted by

Finance Guy

at

2:00 PM

0

comments

![]()

Monday, September 29, 2008

I reiterate, this is not a bailout...

I said this to a friend today, and I repeat myself here: Today, I felt like the man holding the "World is Ending" sign while the world ended around me, feeling vindicated but just as dead as everyone else.

Today's massive stock market sell off is the reason we need the liquidity injection: there is no other sane solution.

Complain all you will about "your money" or "tax payer" money, but when 50% of the population is invested in one way or another, when the market tanks 10%, you will definitely be hit.

And think, that was just one day without a bailout plan. Imagine days upon days.

The longer we go without a bailout, the longer the recession will be and the costlier the bailout will be.

Remember, when Wall Street fails, the first to get fired is Main Street. Don't believe me? Consider all the ibankers that were kept by Barclays. Now point out to me the Lehman Brothers janitor that kept his job?

Inject liquidity now or risk full economic collapse. To all the "Capitalism" screamers, remember what pure capitalism requires: a stable economic environment.

And to all of you screaming "The public doesn't want it", I have two things to say:

1) As I said already, Main Street and Wall Street are the same street, only that Main Street people have significantly less money. If Wall Street gets hit, Main Street gets fired first

2) Financial policy should never be left in the hands of people who don't know economics or finance. Just like you leave surgery to doctors, you should leave financial policy to financial professionals.

Posted by

Finance Guy

at

10:56 PM

6

comments

![]()

Wednesday, September 24, 2008

Understanding the $700B "Bailout"

Thanks to Les for bringing this subject up...

I have been thinking about this for a few days, but since I'm surrounded by finance people, there has been very little debate, since we all pretty much agree on its necessity. However, after reading what's out there in the mass media and debating with non-finance people, I have realized there is a significant gap in understanding.

First out, the $700B is not:

1) A blank check

2) An one-time authorization

3) A bailout

The $700B being proposed has a specific purpose: it is designed to add "liquidity". It will add money into markets that are currently skittish. Primarily, it will focus on the distressed mortgage-backed securities. The principle reason for many write-downs and the failure of multiple financial institutions is because there is little to no money currently wishing to buy them. When a market has all sellers and no buyers, its no market at all. When there is no market, there is no price, and assets without price immediately have no paper value.

The amount of the "bailout" is a subject of debate, but a rather moot one, since the plans call for up to $700B in securities to be sitting on the government's balance sheet at any time. These securities can be bought and sold constantly, as long as the total is never over $700B.

Finally, the notion of bailout provides the idea that the government is lending help to "Wall Street fat cats" who couldn't properly manage risk. It is not a bailout. The government is merely providing liquidity at a time when assets are severely distressed. The term distressed means the asset is very cheaply priced, perhaps below intrinsic value. Since the government has the ability to borrow large amounts of money and is very patient, allowing the government to buy cheap assets and hold over the long term not only provides liquidity, but it will make money in the long run as the market for these securities come back.

This situation has happened once before. I link to the Wiki entry here.

Currently, most of the sane Senators have also realized the need for this "bailout". The real discussion is over minor, what I refer to as punitive, details, such as CEO compensation, mortgage foreclosure help, and the use of equity warrants whenever the government helps with a distressed asset.

Hopefully, these issues will get hashed out soon, since the financial stability of the US depends heavily on a stabilized market for these assets.

Posted by

Finance Guy

at

11:16 PM

3

comments

![]()

Monday, September 22, 2008

Markets in Turmoil

Man, what a crazy week its been.

Beginning with the liquidity crisis at AIG, the markets went on a roller coaster ride of epic proportions. Hourly, the potential for AIG's demise created more fear in the markets. Finally, when AIG had fallen below $2 a share, the government reacted and initiated one of the largest public bailout deals.

However, the days after were not much rosier, with Lehman Brothers filing for bankruptcy, Merill Lynch merging with Bank of America, and both Goldman Sachs and Morgan Stanley filing for bank holding company status.

Tonight, all of the world awaits a decision by the US Congress to enact a bill that will not only save the US financial markets, but the worlds.

Melodramatic as that last statement may be, it is really the ultimate effect of globalization. Nothing happens in the US that doesn't affect the world... and vice versa.

Posted by

Finance Guy

at

8:38 PM

1 comments

![]()

Tuesday, September 9, 2008

Current Outstanding Debt

I finally put together all my current outstanding debt obligations.

I finally put together all my current outstanding debt obligations.

While a significant portion of my debt has already been budgeted for, previously, I did not have a good handle on how much to pay on the credit cards or what to sock away to pay back my parents.

Taking the remaining portion of my monthly income, I have written in red the expected monthly payments, which still allows for a small portion to of my income to be saved for a rainy day.

Obviously, my credit card debt will not be paid in full by the the time their respective 0% offers expire, but I hope to roll the remaining debt to one more year of 0% interest, while also planning to plow a significant portion of my year end bonus into them.

Posted by

Finance Guy

at

11:59 PM

6

comments

![]()

Thursday, September 4, 2008

Day 3 - Understanding by Total Income

I went back to my financial planning sheets and reworked my income estimator. Before I figure out how much money I need to save additionally to pay down my debt, I first needed to know how much I had to play with.

I went back to my financial planning sheets and reworked my income estimator. Before I figure out how much money I need to save additionally to pay down my debt, I first needed to know how much I had to play with.

To the left is the percentile breakdown of my salary into each expense category. At the end, I realized that I had been underestimating how much I had left over each month by 50%.

Rather than the 6.68% left, I had though I was at 3% and so I had been constantly worried about my bank account emptying. This is one positive piece of news.

Every day I will continue to revamp my sheets to become more and more accurate. While the preliminary debt figures are ready, I will wait until this weekend to post them so that I will have some time to also provide a plan to pay it down at the same time.

Posted by

Finance Guy

at

10:36 PM

0

comments

![]()

Tuesday, September 2, 2008

Day 1 - Formulating the Plan

While a full account of my current financial standing is forthcoming, looking in my fridge suggested to me my first easy and obvious budget planning measure: cooking more meals at home rather than eating out.

I went to BJ's today and bought a full stock of pasta, deli meats, and other basic salad and lunch combination items and then spent the next 3 hours preparing different choices for the next week. Lunch typically averages about $7.50 a pop, while the food I bought will probably be about $4 a pop, saving about $14 a week. While small, this also has an immense health benefit.

In addition, I had already embarked on my coffee savings plan by grinding and brewing my own morning coffee, but I have now also decided, for both health and economic reasons, to forgo my afternoon cup of joe. The afternoon coffee alone will save me about $11.25 a week.

By tomorrow, I should have a full financial picture and better Excel accounting sheets to track my expenses and then budget out each of my bills. But already, with these two measures, I can save an extra $100 and put it toward paying down my debt.

Posted by

Finance Guy

at

11:30 PM

1 comments

![]()

Labels: budget

Monday, September 1, 2008

Rock Bottom

For anyone with an addiction, rock bottom is that point where the addiction has forced upon them a situation of utter nothingness. A sense of dismay with life. While I haven't actually reached that point, I see it coming in the future, and rather than waiting for it, I am going to address it now.

For the past month, I have found it difficult to blog about my financial life. As anonymous has pointed out in comments, things have very much taken a turn for the worse. My investments, while left ignored, have dwindled to nothing. My bank account continues to be drawn down due to constant trips to the casino. Sure there are times that I win, but I find myself losing more and more. In addition, I have been using credit to finance some of life's unavoidables, such as work clothes or a flight to a friend's wedding.

While none of these items have forced me anywhere near bankruptcy, nor am I near any kind of debt held by the average American, I know this is not responsible fiduciary behavior.

Ironically, I have often complained to myself that I had little to offer the world, since my finances are so different from average. But now I find myself in a situation that anyone could relate.

From hereon forward, I will be changing my goal. My near term (1-yr) goal is get rid of my credit card debt. My long term debt with my car and student loans are still on track and will continue to be paid down in regular installments.

This blog will then be about how I balance my new focus on decreasing debt, while trying to maintain a similar (but not the same) lifestyle.

Moving forward, my daily posts will be about my plans, my progression, and little things I'm doing to turn around my financial situation.

PS - I have not turned off the anonymous commenting. While to the point and typically stinging, I feel that posters should take some responsibility in what they write. After all, it is my life. While I open it up for debate and advice, I am not inviting you to be my mother. I already have a mother for that.

PPS - It will take me a little time to update the blog with my new debt figures and to formulate a plan. Give me some time.

Posted by

Finance Guy

at

9:21 PM

2

comments

![]()

Thursday, August 21, 2008

Condo Time?

As the dollar weakens and oil prices continue to rise, I constantly find myself veering toward one asset class that seems incredibly undervalued, in high supply and with relatively low demand: real estate, and specifically a condo for myself.

Every month when I pay rent, I'm realizing I'm helping someone else grow equity in their real estate. My lease is up at the end of November. I haven't really been enjoying much of the facilities here nor the general upkeep of the common areas. Coupled with falling prices and the fact that I will be here for at least another 2 years, I think it would be a great time.

My only real concern is with the availability and cost of credit. While my parents are willing to help me out with the 20% down payment, I will still have to find me a lender and that will be tough.

However, if I can manage a rate of 6% or less, I should be able to purchase between $200-$250K condo at my current rent payments. What I'm hoping for is to low ball a $250K house for about $200K and then see it pop back to its true value within a year.

I'm going to start condo hunting soon.

Posted by

Finance Guy

at

10:26 PM

4

comments

![]()

Sunday, August 17, 2008

Flying back

Man does it hurt to pay for internet in the airports. Of course, as an economist, I should have predicted the obvious heightened demand for internet in airports with the clear lack of supply as an obvious invitation to jack up prices. But still, $9.99 for access?

I pay maybe $40 a month at home while at the airport, its 25% of that for maybe 3-4 hours. What a great rip-off airports are pulling off, on top of the ridiculous airport fees they already charge.

But what choice do I have? I have to be here 2 hours earlier to pass security.

Oh well, at least I can log onto internet poker and try to win my money back.

PS - I'm up $10.10 and so net, I'm up 11 cents! Woo hoo.

Posted by

Finance Guy

at

12:13 AM

0

comments

![]()

Thursday, August 14, 2008

In the Airport

Sitting here in the airport, waiting for my United flight, I have to admit I'm a bit anxious. Their pilot's union is in a very public battle to oust their CEO Glenn Tilton. In the meantime, United has instituted a multitude of nickle and dime efforts, starting with what is now an almost industry standard: charging for checked bags.

At the checkout counter, I encountered another money-generating scheme, paying for seats in the forward cabin that have a bit more foot room but still in the economy class. As more and more of these measures become instituted, I have to wander just how far will they go?

With justifications such as high fuel costs as a reason to charge for each checked bag, I'd expect people to be subject to the same rules. Thinner people will receive discounts while the bulkier will be levied surcharges. Maybe window shades will become metered, 25 cents per 5 minutes?

Airline travel isn't what it used to be. And I think it can really only get worse.

Posted by

Finance Guy

at

7:03 AM

2

comments

![]()

Networth Update

Well, July's networth update was a bit late, but only because I haven't had time until now to put it up.

Well, July's networth update was a bit late, but only because I haven't had time until now to put it up.

The results are reminiscent of my 4th grade report cards: not good, but improving.

My networth is -$10,303.66 or a rise of $306.59 month over month. While brewing my own coffee has cut down quite a bit on my food expenses, my continued eating out and altogether enjoyment of the summer months is taking a toll.

In addition, the market has not been helping out much, with my investment accounts, 401(k) and restricted stock units either taking hits or stagnating.

Overall, I am still -1.03% away from my goal.

Posted by

Finance Guy

at

1:25 AM

2

comments

![]()

Labels: networth

Tuesday, August 12, 2008

Blog posts are coming...

Just hang in there folks. I've got my end of July networth update along with 3 new trading strategies I've been working out.

However, with the hooplah of Olympics and my new-found exercise regiment, its been a bit tough to get to blogging before 1AM.

Come by tomorrow, and there'll be content!

PS - Michael Phelps is doing amazing.

Posted by

Finance Guy

at

11:49 PM

0

comments

![]()

Tuesday, August 5, 2008

Guaranteed way to win the Powerball

It's been a while since I've posted a humorous but financial interesting post. Today at lunch, I had an interesting (and financially geeky) debate over how much the Powerball lottery would have to be to make it worthwhile to purchase every possible number combination, thereby guarateeing a Powerball win.

It's been a while since I've posted a humorous but financial interesting post. Today at lunch, I had an interesting (and financially geeky) debate over how much the Powerball lottery would have to be to make it worthwhile to purchase every possible number combination, thereby guarateeing a Powerball win.

Powerball is won by choosing 5 numbers and the Powerball number correctly. According to the Powerball site, the odds of doing so is 1 in 146,107,962. Since every Powerball ticket costs $1, theoretically, you can spend $146,107,962 or about $146 million to acquire all possible combinations.

But of course, it's not that simple.

Assuming you had $146 million, the jackpot would need to be a lot bigger than that to provide you a return. Remember, due to inflation, the value of $146 million today is not worth the same amount of goods you can buy with $146 million 30 years from now.

So how much would it have to be?

Looking at the website, it appears they assume a 2.38% inflation rate each year. In that case, you would need the jackpot to be worth $296,164,788 just to breakeven. But of course, there is something else to think about.

Remember that money used? That is money after tax. When you win the Powerball, you still need to pay taxes. Assuming a lump sum, and applying the highest tax rate of 35% for all winnings over $357,700, you'll need a jackpot of $456,099,627.

Unfortunately, this situation hasn't occured yet. To date, the largest Powerball winnings was $365 million (link).

Additional Issues

Since it is currently a net negative return on your investment (until the jackpot is larger) to try this method of winning the lottery, I won't delve into other considerations that will require the jackpot to be substantially larger. However, here are some issues we kicked around:

- Logisitics of storage/retreival of such an amount of lotto tickets. How much would that cost?

- What if you have to split the winnings?

- What if you accept an annuity and die early?

- It's possible an out-sized purchase of 146 million tickets could balloon the overall pot, which could statistically increase the number of people buying tickets, and therefore the number of people splitting the winnings.

Posted by

Finance Guy

at

8:56 PM

2

comments

![]()

Sunday, August 3, 2008

Disputing Late Charges on Credit Cards

Don't take late charges sitting down. Credit card companies already make plenty of money from you, and if you have a legitimate reason for being a few days late on your payment, be sure to call up. They can most likely reverse the charges.

This has happened twice to me already. I pay all my credit card bills online, so on a regular basis, I submit authorizations on the credit card company's site to take money from my bank account on the payment due date. The two times I forgot to do this, I was very busy and just forgot until a few days after the payment date.

At the end of the next cycle on my most recent situation, two charges were slapped on. A late charge for $39 and a finance charge of $5. I immediately called up the credit card company and as soon as I asked about the charges, the customer rep offered to remove them while providing the helpful hint that I should pay on exactly the right time to avoid these charges.

This is great for those of you out there who can pay on time but occasionally get busy and/or forgetful. Of course, if you are unable to pay or haven't paid for over a month, this method may not help you.

But you should at least try.

Posted by

Finance Guy

at

8:54 PM

0

comments

![]()

Labels: credit cards, late charges

Monday, July 28, 2008

Nearing Bottom

As we approach August, the signs are pointing to a bottom or near-bottom for the market. Small upswings in oil are causing fears that are unprecedented. Banks are failing but the FDIC is stepping in and protecting individuals. Freddie and Fannie's debt is secured.

Now we just have to wait out this week's job and housing reports and we could see greener pastures in Septemeber.

Posted by

Finance Guy

at

9:41 PM

0

comments

![]()

Labels: stock market

Wednesday, July 23, 2008

Market stabilizing?

I don't want to sound too optimistic yet, but we are seeing oil heading toward more fundamentally stable prices at $125 a barrel. Many analysts are predicting a floor of $120 where it will hover for some time.

Definitely, while a lot is behind us, we are not out of the woods yet. Banks need another positive quarter. We need to see the housing market bottom out. Oil and dollar needs to stabilize. Then, we can finally call an end to this mini-recession.

Posted by

Finance Guy

at

11:38 PM

0

comments

![]()

Labels: stock market

Monday, July 21, 2008

Saving money making coffee

As I continue my journey to save money on everyday goods, I started digging around and found some starbucks beans that were unopened. I decided to make 10 cups of coffee and chill in the fridge. That should provide about 5 days worth of morning iced coffee.

The beans I originally bought for about $7 and they can probably make about 60-70 cups of coffee. Considering I had been paying $2.25 for a coffee from Dunkin Donuts, that's about $78.75 I wouldn't be spending, netting $71.75 in savings. However, the coffee machine and grinding equipment cost about $150.

So within two bags of coffee, I will have at the very least paid for all the equipment and beans and well on my way to savings.

Anyone else doing these little things to save money?

Posted by

Finance Guy

at

10:52 PM

2

comments

![]()

Friday, July 18, 2008

"Naked" Market Outlook

Don't be fooled by the last two days of positive momentum, nothing fundamentally has changed in the US economy to validate such positive behavior.

While certainly banks having given themselves some more breathing room and oil has been dropping like a paperweight, macroeconomic characteristics such as GDP growth, unemployment, and housing starts do not show any sudden changes.

More than likely, we are seeing a quick response to the government's new short selling rules, which no longer allow "naked" shorts on 19 financial stocks. Traders now have to prove they have arranged for these shorts before they can do so.

Many consider this rule to effectively prevent shorting of these 19 stocks, and certainly a good reason why the financial sector is suddenly doing so much better.

Here is a link to the list (See Appendix A): SEC Release

Comment: It's surprising how hard it was to actually find the full list.

Posted by

Finance Guy

at

6:44 AM

0

comments

![]()

Labels: financials, stock market

Tuesday, July 15, 2008

Starting new rotation

Monday marked the first day of my new rotation. My last rotation was in Financial and Planning Analysis. This one is Reinsurance Security. This should be a totally new experience for me, and a far cry for the other FP&A roles I have tried.

Reinsurance Security is essentially counter-party risk analysis, analyzing the credit worthiness of various companies we do reinsurance business with. Today, I am already working on analyzing a small company that we will be providing approval/disapproval notices on.

As I get in this, I find it so interesting that government allows some of these corporations to exist. So many of these companies are pure shell companies, pretending to hold on to liabilities of another company, but being wholly owned by them.

Much of this is reminiscent of the sub-prime mess, and in a very real sense, many of the mortgage reinsurers went down for precisely this reason.

As with many things in my life, things seem to always fall on my plate when they are really hot. And this field right now is on fire, with the demand for good credit analysis at ridiculous levels.

This will certainly propel my career along, and at the same time, there's some trepidation that I may not learn all I can in this one-year rotation.

Posted by

Finance Guy

at

12:37 AM

1 comments

![]()

Labels: career

Wednesday, July 9, 2008

Be wary of credit card deals

Recently, I've been keeping a keen eye out for balance transfer deals that charge little to no fees for transfers. However, more often than not, I am seeing deals that offer very low APRs (0.99%) with 3% transaction fees.

While 3% transaction fees are normal, most credit card companies cap this fee to a certain amount. The cap can range from $50-$200. Make sure to read the fine print on each of these offers. Those transactions fees can mean the difference between making some easy interest money off of borrowed money or losing all that interest in the transaction fee.

Consider for example a $5,000 transfer. At 3%, the fee should be $150. With a cap of $50, the real transaction fee is 1%, while with a cap of $200, the real fee is still 3%.

Also, be careful of using balance transfer offers from credit cards you actively use. I made this mistake a while back. I charged about $50 to a credit card before I did a transfer of $8,500. Unfortunately for me, since I now carry a balance month to month, that $50 is accruing interest at 10% while the balance transfer has a 0% interest rate for the promotion period.

Obviously, dollar-wise, its not a lot, but the principle of the matter is very annoying.

Posted by

Finance Guy

at

10:47 PM

3

comments

![]()

Labels: credit cards

Monday, July 7, 2008

Bank Deals

Recently, I've been shopping around for a new bank because my current one is closing its branch near my work. While looking, I checked my Bank of America account and noticed that they were offering two deals.

(1) They were offering me $75 to open an account, if I funded it with $25 because I hold a credit card but have no other accounts with them.

(2) They were offering me money to refer a friend, and if they signed up, both of us would get $25.

Both are easy ways to make some quick money. Check them out.

Notice: Bank of America is not providing me any consideration for this post. This is purely to provide information.

Posted by

Finance Guy

at

8:10 PM

0

comments

![]()

Labels: banking

Tuesday, July 1, 2008

Networth Depression

Clicking on other personal finance sites recently, I'm finding myself both depressed and challenged by many of them.

While others are having similar issues forcing them to stray from their budgets here and there, many people are well on their way to a high positive networth.

Unlike them, I am still lugging around a negative networth, primarily due to my student loans and one year of job experience.

I am going to continue reading those sites, and see if I can gleam their secrets and apply them to myself.

Certainly my most important month to month finance goal is to stay on budget. For too long, I have lived on the philosophy that my salary will outpace my spending.

This is simply not true.

Posted by

Finance Guy

at

10:10 PM

1 comments

![]()

Labels: networth

Monday, June 30, 2008

June Networth Update

Well, here I am: head hanging in shame. I've blogged about this previously, but here I am with the real results of this spend-freely-forget-the-budget month.

Well, here I am: head hanging in shame. I've blogged about this previously, but here I am with the real results of this spend-freely-forget-the-budget month.

My networth dropped to -$10,610.25 from -$10,570.00. My networth is going backwards, and this is unacceptable.

My investment account is a little negative, but pretty close to about even, as the past two weeks of volatility has taken a toll.

I also spent today re-doing my budget. I started by adjusting my base salary, as I am expecting a 6-10% increase starting in July. I was very conservative, and only assumed a 5% increase. With the increase, I then adjusted up my gas, food, utility, and discretionary budgets while also ensuring I am saving $150 a month more than before, if I stick to my budget.

This is going to be gradual climb back to fiduciary responsibility. Stay tuned.

| |

Posted by

Finance Guy

at

11:45 PM

0

comments

![]()

Labels: networth

Sunday, June 29, 2008

Bear Market and Bear Bank Account

Two items to think about this post:

(1) Bear Market - I believe this week will continue to see the market decline, but not as badly, as investors began to see some discounted values out there. However, with the European Central Bank poised to raise interest rates, which will shore up the Euro and cause the Dollar to fall, we will also see oil prices continue to shoot upward.

Additionally, financial stocks are still being targeted by both investors and rating agencies as the fear of more write downs to come applies continuous downward pressure on those stocks.

(2) Bank account - For regular readers, you are all aware that this month has been financially very bad for me. After tallying up everything up to today (with 1 day left in the month to go), I am about $1,100 above budget on spending. I need to be very careful next month to ensure I have enough funds in my bank account to cover all my bills.

Just as important is my continued plans to recover from this month. Tomorrow, I will reset my budget to be in line with rising costs of food and gas, while also setting aside money to pay down debt.

Posted by

Finance Guy

at

10:26 PM

0

comments

![]()

Labels: bearish market, personal finance

Friday, June 27, 2008

Bearing down

So far so good. The market is definitely reacting to all the negative economic news. All major indexes are down. My Dow and Financial Sector shorts are working out well. If we see another 300+ point drop tomorrow, I may cash in, instead of being greedy.

Posted by

Finance Guy

at

12:09 AM

0

comments

![]()

Labels: bearish market

Tuesday, June 24, 2008

Feeling bearish

Today was the first time since I've started investing and trading that I truly felt bearish about the next 6-months in the economy. With oil fluctuating wildly, the Fed spinning inflation out of control, and basic material prices shooting up, its tough to believe that the general market is anywhere near its bottom.

Sure, I still believe there are some sectors out there that could do well. For instance, technology companies, specializing in infrastructure and communications, will benefit greatly from widespread travel budget cuts.

However, financials will continue to suffer along with the construction and medical industries.

Maybe the Fed will say something intersting for the economy at the conclusion of its meeting tomorrow, but its doubtful.

It's a wait and see game. And so far, we've been waiting and seeing the market go down.

Posted by

Finance Guy

at

10:49 PM

0

comments

![]()

Labels: bearish market

Monday, June 23, 2008

Back on the blogging (and budget) wagon...

It's taken a while to get my life settled down enough to start blogging again. The past two weeks have been incredibly hectic, both at work and away.

Looking at my expenses, I am about $900 (including $220 in car taxes) over budget across all my accounts, my options trades have been in the red due to the volatility of the market, and I have at least one plane ticket I need to purchase for a wedding that I have yet to do.

So what is my plan?

1) I need to get my option trading back on track

2) I'm going to clamp down again. My upcoming salary increase should help, but I'm not banking on it. At current rate, I'll need a 10% increase to match what's going on. That high of a rate is doubtful.

3) Going to re-do my expense and budgets to account for all the little things that have changed, such as gas and cable bills.

It's tough to get back on the wagon when you've fallen off. But I'm going to try.

Posted by

Finance Guy

at

11:32 PM

3

comments

![]()

Labels: budget

Not on track

Wow, just checked out my expenses for this month, and I am not on track at all. While my coffee purchases have declined significantly, my bar and restaurant tabs have increased exponentially. Summertime has always been bad for me, but I know just how bad...

More to come later.

Posted by

Finance Guy

at

6:34 AM

0

comments

![]()

Labels: budgeting

Wednesday, June 18, 2008

Lows = opportunity

Markets are hitting lows with oil falling. Time to believe in tech and the Nasdaq again.

Posted by

Finance Guy

at

5:37 PM

2

comments

![]()

Sunday, June 15, 2008

Looking forward to July

Just got word that my next rotation is going to be focused on security and risk analysis. I'm super excited. Not only was this my top choice, but I was one of many who applied for this rotation. The skills I will get to build out in this rotation will definitely be good on the resume for my switch to i-banking.

This may come as a shock to some readers, but that is my real end-goal. As a young MBA, ibanks will not hire me as an Associate level. Instead, they would make me work my way up.

Knowing this, I have chosen a leadership program to go through to pick up all the necessary soft skills I would need in a condensed period of time. Along the way, I'm selecting my rotations that easily translate to the ibank world.

In addition, when I do rotate in July, I should also see a pay raise. My guess is 5-7%, but I have heard of numbers as high as 10%.

Keeping my fingers crossed.

Posted by

Finance Guy

at

10:50 PM

0

comments

![]()

Labels: job

Wednesday, June 11, 2008

Market Correlates to my busy weeks

I swear: the market's downward moves are always correlated to my busiest weeks. This week has been the busiest week in months for me, and the market of course is dropping the most it has in months. I barely have time to check my accounts or blog this week, but I know the markets are just awful.

In the future, I will warn readers of my busiest weeks so that they can start shorting their stocks.

Posted by

Finance Guy

at

10:53 PM

0

comments

![]()

Sunday, June 8, 2008

Personal Note

Just realized how much I spend on coffee every month. Its scary. At $2 a coffee and 3 times a day, that $30 a work week and $120 a month. And I don't need it! I should just be getting more sleep, which would actually add health value as well.

Starting that this week.

Posted by

Finance Guy

at

10:15 PM

1 comments

![]()

Get ready for Monday madness!

Okay, so not football season quite yet, but with Friday's gigantic across-the-board stock index drops and oil price's rocket upwards, I can only imagine that tomorrow is going to be another wild and rocky day.

There's really two ways I see Monday shaking out:

1) Investors are still jittery and continue to sell off

2) Investors realize we are at a bottom and a huge rise will occur

In my opinion, with the amount of positive economic news out there and with many major blue-chips trading at lower than normal P/E ratios, it will more likely be #2.

Consider for a moment the causes of Friday:

1) A record one-day rise for Dow the previous day (taking quick profits)

2) Oil's sharp rise (there's only so much higher it can go before speculators pull out, magic number? $150)

3) Unexpectedly more negative unemployment numbers (seasonal adjustments are not being properly factored in, and even if they are, the numbers still reflect no new news about the economy)

All three reasons that pushed me over the edge on Friday to buy at the end of the day.

Posted by

Finance Guy

at

2:47 PM

0

comments

![]()

Labels: stock market

Wednesday, June 4, 2008

Summer Time

I always find it much harder to stay on top of my expenses in the summer time. There is just too many possible fun events that one can attend. Additionally, there are now actual things to do, versus winter time when I'm just bored and wished there were things to do.

I haven't quite figured out how to manage myself appropriately during summer months. However, as with all my personal finance guys, I feel that if I blog about the issue, it will force me to be more accountable.

Posted by

Finance Guy

at

11:58 PM

2

comments

![]()

Monday, June 2, 2008

May Networth Update

This month started well, with my expenses well within my budget. Then I found out my buddy in Florida was about to get fired and he wanted us to fly down and enjoy a weekend there before he had to find another job.

This month started well, with my expenses well within my budget. Then I found out my buddy in Florida was about to get fired and he wanted us to fly down and enjoy a weekend there before he had to find another job.

Quickly, the expenses piled up.

Thankfully, with the adjustments I talked about last month, I still made some progress.

My current networth is -$10,570.00 or -1.05% from my goal.

My investment account is doing okay, with the current standings actually around, as I still have some options I have bought that I have yet to sell.

Posted by

Finance Guy

at

10:41 PM

1 comments

![]()

Labels: networth

Saturday, May 31, 2008

Thursday, May 29, 2008

Lookin' good

With oil inventories down and initial claims slightly higher than expected, oil and gold futures continue to fall. This is a positive sign.

The inflationary fears have been kept in check. Falling oil prices continue to stimulate equities.

We may not be out of the woods yet, but more and more analysts are saying what I've been saying: stocks are cheap, tech is good, financials will be back.

Posted by

Finance Guy

at

10:33 AM

1 comments

![]()

Wednesday, May 28, 2008

First Mobile Post

Posted by

Finance Guy

at

8:36 PM

1 comments

![]()

Bubble's first pinprick?

Is it really happening? Is there a sign that the commodity bubble for gold and oil starting to show the first signs of correction?

I can only hope. The correction however is certainly welcome.

Come on oil...fall!

Posted by

Finance Guy

at

6:48 AM

1 comments

![]()

Monday, May 26, 2008

Interesting Career Advice Website

Today I was surfing the 'net and unconsciously I was searching for salary negotiation information.

At work, I am in a three-year rotation program, changing between financial jobs every year. At the completion of each rotation, we have interviews for our next rotation and salary discussions. As with most people, I feel I could be paid more.

In my search, I stumbled upon E-Zine articles and specifically this article.

However, linked to that article are a wide array of career articles I found interesting.

Check it out.

Posted by

Finance Guy

at

11:46 PM

0

comments

![]()

Labels: website

Friday, May 23, 2008

Market Update

Oil is leveling off from its $135 a barrel highs. I expect it to range between $125-$135 for a while, which should easy the negative sentiments of the market. I still believe in what I posted on Tuesday, and I have been buying June options on the cheap.

Posted by

Finance Guy

at

12:39 AM

0

comments

![]()

Labels: investment

Tuesday, May 20, 2008

Market Conditions Seem Bleak...

...with the rise of oil to almost $130 a barrel and core inflation rising.

However, I sincerely believe that there are two phenomenon occurring in the market:

(1) The market is trading in ranges. The expectations is for the market to go +/- 3%. Today' the Dow was down about 1.5%, so I expect at least another big down day, and the market will rebound. In general, investors have been flaky, alternating between lots of optimism and instant reaction to any kind of economic news

(2) Rising oil prices is one of those pieces of economic news that investors have been overreacting to. However, it appears that speculators are also happy to trade within ranges, with big oil price spikes resulting typically with big oil price drops. Additionally, I firmly believe rising oil prices should already be built into the market, and so in about a 6 months, this should all even out.

With those two in mind, I am planning to buy both DIA and QQQQ (Dow and Nasdaq ETFs) Call options tomorrow afternoon, when I believe both will be near their low points.

Posted by

Finance Guy

at

11:18 PM

0

comments

![]()

Labels: investment

Sunday, May 18, 2008

Long-term investors beware...

In a recent MarketWatch article, Chuck Jaffe who writes a column titled "Stupidest Investment of the Week" (link), talks about a specific Vanguard mutual fund that essentially invests all the other managed Vanguard mutual funds. Jaffe suggests, and I agree, that this type of diversification is over-diversification, or a type of risk aversion akin to keeping your money under 8 mattresses instead of one.

While most readers know I enjoy risk, my retirement funds are long-term focused. I've often debated the risks of holding one good stock (leading to high risk) or just holding something safe (Treasury bills). Classic finance would tell you that the ideal location is somewhere in between; a good mix of high risk and low risk investments.

Jaffe writes, "Studies have shown that holding more than four funds that cover the same ground results in a 'closet index fund,' where an investor pays the price for active management but winds up with the performance of an index fund."

People sometimes take mutual funds and diversification too far, believing that spreading their money around to various mutual funds meets the criteria of diversification. Instead, look at each mutual fund's holdings and find out if you are duplicating sectors. If you are, rather than holding two mutual funds and paying double the management fees, just put twice as much into one mutual fund and get out of the other.

Posted by

Finance Guy

at

11:20 PM

2

comments

![]()

Labels: investment

Wednesday, May 14, 2008

Stock Market

Today's stable inflationary figures coupled with Congress' suspension on buying oil for the Strategic Oil Reserve caused a large bump in the stock market. During this time, I sold off half of my Dow call options, making about $300. Unfortunately, I'm still in the hole for other options that I have bought.

During the afternoon, the market began to dip, as finicky traders began to take advantage of the large uptick to make some quick profits. By day's end, the upward movement had been halved. Believing that this downward pressure was purely speculatively based, I bought in near the end of the day on both the Dow and Nasdaq ETFs, hoping for another quick pop tomorrow.

[Update] Attached is my current spreadsheet. For trades where I have yet to sell, I have added the current market value of the options in orange with an estimated trading cost. As you can tell, one trade in particular has had a huge negative effect on my overall profit:

Posted by

Finance Guy

at

10:52 PM

0

comments

![]()

Labels: investment

Monday, May 12, 2008

Stock Market Updates

A recent reader asked for my an update to my investment experiment with credit card debt. Unfortunately, there isn't much to tell yet. Last Thursday and Friday, I bought in Dow Jones Industrial Average ETF Call Options, thinking the market was severely battered by what I believed to be high speculative oil prices.

This bet has been proving well for me today, with oil prices coming down. The DJIA has also been helped by positive expectations for tomorrow's earnings report from Wal-Mart.

Along with Wal-Mart's first quarter earnings report, retail sales figure will also be released. This is a key indicator of consumer spending patterns. The market expects a downward pressure, in line with general thoughts of recession. If this measure is neutral, or if better positive, the market will react very positively, perhaps seeing another flirtation with the mythical 13,000 mark.

Posted by

Finance Guy

at

8:04 PM

0

comments

![]()

Labels: investment

Thursday, May 8, 2008

Stock Market

With oil prices rising, and Dow Jones component AIG reporting 100% greater losses than analyst estimates, the market is looking difficult to stay in the black tomorrow. However, I am still optimistic.

Today's jobless claims data was very positive and the overall daily rises in oil prices has actually been decreasing. On top of this, both the Fed and the Bank of England have decided to hold interest rates steady, suggesting the world economy is turning around.

Right now appears to be a great time to jump into the market. I've just sat on the sidelines and bought in during big down days and selling on the inevitable pop a few days later.

Try it out.

Posted by

Finance Guy

at

11:58 PM

1 comments

![]()

Labels: stock market

Tuesday, May 6, 2008

Cheap way of getting rid of tree sap on your car

(if you're in a hurry, scroll to the bottom to find out how)

That's right. Summer season is upon us, which means tree sap is dangerous for any shiny car haphazardly parked under a tree.

Today, visiting a field office, I made that mistake by parking in the visitor's parking lot, right under a tree.

It the afternoon, as I walked around my car to get in, I noticed that the entire top of my car seem to have been splattered by something wet. Upon closer inspection, the spots were a bit gummy and impossible to remove.

I got in my car, tried the windshield fluid on the spots on the windshield to no avail. I finally decided to ignore it for the major washing and detailing I had planned for this weekend.

But, while sitting on my couch watching TV, I began to worry about the spots being permanent. I had remembered at some point a car enthusiast on TV yelling about the dangers of tree sap to car paint, so I tried that on Google.

Viola! The first link for tree sap removal brought me confirmation that tree sap was the problem and the solutions. They ranged from almond mayonnaise to WD40. Apparentally, people had tried everything.

But finally, I found one solution that everyone agree would work and had no negative remarks about: basic rubbing alcohol (70%). I did as suggested and poured some on a clean cloth and wiped it on a small spot. It disappeared immediately. I then spent the next 15 minutes pouring rubbing alcohol on my car and wiping. Now its all gone with no damage to the paint!

As it turns out, rather than buying some expensive specialty remover or going to a professional carwash, the solution, rubbing alcohol, was in my apartment already.

Posted by

Finance Guy

at

11:14 PM

0

comments

![]()

Labels: tree sap removal

Fuel Tax Break

Every time I post an entry like this, I always preface that I rarely stray into politics on this blog. However, in the case of the fuel tax break, I have to because it relates directly to personal finance.

Let me state it plainly: suspending the fuel tax is stupid.

The fuel (gasoline) tax is a pure consumption tax whose proceeds are designated for infrastructure maintenance and expansion. Rather than taxing the population at large, the greater users of gas, and therefore of public infrastructure, bear the greater weight of the upkeep.

By suspending the fuel tax, where does the money necessary for infrastructure upkeep come from? Well, real taxes, since roads HAVE to be maintained. Essentially you would divert already earmarked funds into the roads, if not take out loans to pay for it.

Many argue that this is an elitist or rich man's argument. It is not. There are 3 primary reasons this is better for the average Joe:

(1) Rich people have more money. They can already buy more gas and keep prices high. If the price dropped, they would want even more gas. Gas will go back to that price, and you would still be in the same place.

(2) Before, rich people already drove more and therefore paid more to maintain the transportation infrastructure. Without those funds, the money would come from general tax revenues. In general, most people would think rich people are paying much less tax relative to average. By taking money from general taxes, we would only widen this gap.

(3) Gas prices are not high because of taxes; it is because we are in high demand of it. Keeping prices high forces efficient car technologies, such as hybrids, to be developed, both saving the environment and costing the average consumer less.

Remember that we elect politicians to make TOUGH decisions that affect the LONG term. If they made decisions based on what everyone wants in the short term, the country would be (already is?) in great trouble.

(And yes, I am an economist, so Hillary doesn't agree with me and believes I'm elitist for having studied economics and wishing to inform the world of my opinion. This, coming from a Yale graduate...)

Saturday, May 3, 2008

April Networth Update

This was an interesting month, where I found myself on the short end of a bank account when I accidentally paid my credit card bill the day a bill was generated, rather than the due date. This along with a week-long visit by a friend, where we indulged on steak and seafood much of the week, caused this month's networth growth to be a meager $600.

This was an interesting month, where I found myself on the short end of a bank account when I accidentally paid my credit card bill the day a bill was generated, rather than the due date. This along with a week-long visit by a friend, where we indulged on steak and seafood much of the week, caused this month's networth growth to be a meager $600.

My current networth is -$11,162.59 or -1.12% from my goal.

However, as many of you know, I have embarked upon an interesting venture, which by October, could net me a one month big jump or decline, depending on my investment picks.

If you look at my networth statement, you can see that Card #1 has a huge outstanding debt, which is offset by a $6,500 investment account asset. I have borrowed $8,500 at 0% from that card for 6 months, and I'm investing $6,500 of it in the stock market, while holding $2,000 in my bank account collecting interest. I hope that this two-prong method will allow diversification in this "investment" and provide me a net profit after I pay back the loan.

I've included my networth chart below, and you can see that the past few months have not been good for my networth goals. I will have to work hard in May to get back on top.

Posted by

Finance Guy

at

3:19 PM

3

comments

![]()

Friday, May 2, 2008

Investment Update

On Thursday, after the Fed announced a rate cut and indicated future rate cuts were on a hiatus, the market reacted unexpected, crashing after about 30 minutes of upward momentum. I thought this was the wrong way to react to such a positive economic indicator, and I bought more Dow Jones Industrial Average ETF Call Options.

Today, the market thought about the news, and reacted very positively, ending over 13,000! This helped me make a quick one-day profit. The following is my current position: In the month of April, I've netted $555.24 in trading profits, or about 6.5% of my original loan, surpassing my monthly 6% return goal.

In the month of April, I've netted $555.24 in trading profits, or about 6.5% of my original loan, surpassing my monthly 6% return goal.

I will be taking my profits out around middle of May to pay back principal, and fees on the loan.

Posted by

Finance Guy

at

12:49 AM

7

comments

![]()

Labels: investing, loans, stock market

Tuesday, April 29, 2008

Investment Progress and Outlook

Despite my own cautions yesterday, the Nasdaq continued to transpire against the Dow and S&P, which prompted me to make a quick profitable trade.

As expected however, the Dow and S&P showed that most investors were awaiting word from the Fed. If there is news that a Fed cuts are stopping, then the market will react quickly and optimistically. However, if the news is that the Fed does not see any end to cuts, then the market will drop quickly. More likely though, the Fed will have a 25 bps cut with not much mention of the continuation of cuts.

I did also make one speculative move. I continue to hold my financial ETF, and I bought 5 Dow Jones Industrial average ETF contracts, in the hopes of positive news from the Fed.

The following is a new tracking sheet for my investments, which will better show my trades. I have also included other brokerage fees and added the prospect of taxes.

Posted by

Finance Guy

at

9:39 PM

0

comments

![]()

Labels: federal reserve, investment

Monday, April 28, 2008

Outlook for the Week

After a rough learning curve from late November to January of this year, I have gained some market experience, and have learned that patience is a virtue, especially when acquiring stocks and options.

This week, I am holding off on any major transactions until after Wednesday, when the Fed announces their future policies on rate cuts. Also on Wednesday are large economic indicators, primarily inflation and employment figures.

Barring any unexpected news, I expect Tuesday to be quiet, as the risk is just too high on Wednesday for speculators to take any significant positions.

Items to watch out for this week? USO (United States Oil Fund) and GDX (Gold Index).

Posted by

Finance Guy

at

10:39 PM

0

comments

![]()

Labels: investment

Sunday, April 27, 2008

Investment Update

I've had some very hectic couple of work days recently, and it's been difficult to spend time on this blog. As promised, I will begin accounting for my investments.

My current investment strategy is split between $2,000 in an interest-bearing checking account and $6,500 in investments.

Those investments will be primarily in ETF index options. My investment goal is a modest 6% a month, which is ample to pay back the initial loan fee of $255, and make some money on the free loan during the next 6 months without much time commitment from me.

Here is my current tracking sheet: I am keeping track of each of my investments, and as you may be able to decipher, I have already made one profitable trade worth $190, or about 3% return.

I am keeping track of each of my investments, and as you may be able to decipher, I have already made one profitable trade worth $190, or about 3% return.

I am halfway there to my monthly goal already, and I have yet to begin the first full month of investing.

Posted by

Finance Guy

at

9:08 PM

2

comments

![]()

Labels: investment

Thursday, April 24, 2008

Market Sentiments

The market continues to feel edgy, erring on the side of optimism. With an expected rate cut coming, but with future rate cuts in doubt, the market is wearing its heart on its sleeve, ready to ride the waves of any surprise earnings releases.

Now that I've been burned a few times by this volatility, I am going to sit back and watch the markets closely today. While I now have the money to implement my trading strategies, I will still err on the side of caution.

Posted by

Finance Guy

at

6:48 AM

0

comments

![]()

Labels: investment

Tuesday, April 22, 2008

Here we go financials...

I was expecting the other shoe to drop today on financials, as more big names announce earnings this week. I had also expected some negative news out of National City as well.

With the announcements made by Bank of America and Nat City, I think we are well on our way to the financial sector recovering from its December-January Bear Stearns slump.

The financial sector itself has depressed for several months, with rising inflationary concerns coupled with sub-prime mortgages. However, after this week, my expectation is that the volatility and negative sentiment for this sector will be over. The major banks have laid their problems all on the table, and while there is no smooth sailing, we should expect nothing in the way of surprises in the near future.

At the same time, the tech sector continues to feel good about itself, still drunk on Google profits, and never-ending Yahoo/Microsoft merger deal.

By Friday, I expect to be purchasing both XLF and QQQQ, the financial and Nasdaq ETF respectively.

Posted by

Finance Guy

at

1:00 AM

0

comments

![]()

Labels: investing

Thursday, April 17, 2008

Borrowed Cheaply - Day 1

Today marks the official beginning of my borrowed funds. I chose to borrow $8,500 @ 0% APR until November 1, 2008. However, there is an associated 3% balance fee, removing immediately $255.

As soon as the money clears the bank, I will move it into my trading portfolios. I will then track the outcomes of those portfolios and monthly remove money in order to pay the minimum monthly balance on the loan.

I will keep readers informed and up to date about my progress.

Initially, I am thinking of buying 10 Nasdaq Index (QQQQ) July Options @ 48 and increasing my investment in E-Trade (ETFC), if it falls below $4/share again.

Posted by

Finance Guy

at

11:51 PM

1 comments

![]()

Labels: investment

Wednesday, April 16, 2008

Borrowing cheaply to fund investments - Pt. 4

So just as I was about to embark on my plans, another balance transfer arrived, charging 0% until November 2008, and allowing for $11K. I think I will take these checks with me to work tomorrow, and use them for my trading accounts.

Many are wandering what I am going to invest in, here we go:

QQQQ Call Options for July, XLF Call Options for July, and NCC Put Options for May.

I will report back here once I have started making these transactions and start tracking the results of these transactions.

Posted by

Finance Guy

at

12:08 AM

2

comments

![]()

Labels: investment

Thursday, April 10, 2008

Borrowing cheaply to fund investments - Pt. 3

The final piece of analysis for my cheap loan for investment idea is to consider a classic value-at-risk model. What is the worst case scenario, and could I handle it?

After paying out the 0.50% monthly interest, assuming the very worst, I would need a 28.8% return in the last month to have enough money to pay back the loan + fees and break even.

I think I can accept that. If I become super risk-adverse, I could generate about 2-3% return per month with the possibility of needing to shell out $2,000 at the end of 3 years to pay back the loan.

Posted by

Finance Guy

at

11:48 PM

2

comments

![]()

Labels: investing

Tuesday, April 8, 2008

Borrowing cheaply to fund investments - Pt. 2

After a year of posting, I'm always hesitant in posting my ideas. Primarily, the ideas are met with some mixture of disbelief and outright anger. I don't quite understand why people are not capable of providing some coherent or rational additions to this conversation I'm having with the world. After all, the money I use in my ideas are my own, and I take nothing from any reader who themselves may feel far more risk-adverse than I.

But to answer anonymous questions, and as I stated yesterday, I will be adding the next portion of my analysis today, which is calculating true return I need, post taxes and brokerage costs.

As a starting point, I will use the 4.25% annualized rate from my calculations from yesterday. Short term gains are taxed @ 35% (assuming maximum tax rate). Brokerage fees for me are minimal, but I will say 1 cent per investment dollar.

Therefore: ($8,500 * 99%)*(1+0.65R) = $9,564.11

[translation: (Take Original funds and take out brokerage fees) * (Rate of return discounted by tax rate) and then solve for R to find the break even point for the loan]

where R is the required return for the duration of the 36 months.

R = 21.0%

Annual rate of return to break even is 6.6%.

That rate of return is not that tough to achieve, even just using index funds. However, I will add a third part to it tomorrow that may throw a wrench into this decision: investment funds are declining as I pay interest every month.

Posted by

Finance Guy

at

10:45 PM

2

comments

![]()

Labels: stock market

Borrowing cheaply to fund investments - Pt. 1

Yesterday I talked about the possibility of using the cheap loans banks have been offering to fund investments. Based on an offer of $8,500 for either a 6-month loan at 0.99% or a forever loan at 6%, with a 3% fee on each, here are the numbers: Instead of accounting for the "forever" loan, I just assumed a 36-month loan. Taking into consideration the interest rate and fees, choice 1 is clearly the lower costing loan.

Instead of accounting for the "forever" loan, I just assumed a 36-month loan. Taking into consideration the interest rate and fees, choice 1 is clearly the lower costing loan.

However, just because the dollar cost is lower doesn't mean it is actually better. The 36-month lower has a lower required return rate of 4.25% compared to a return rate of 6.78% for the 6-month loan. Risk is increased greatly whenever higher returns are required in a shortened time frame.

While either return rate is doable in a normal stock market, given the current economic environment, I am leaning toward a longer time horizon. The smaller per month payment also allows me to payout of my pocket earlier on, before I've started generating any real investment income.

Tomorrow, I will work out what I need to make in order to make this venture worthwhile.

Posted by

Finance Guy

at

12:43 AM

2

comments

![]()

Sunday, April 6, 2008

Risk-based Wealth Accretion

Creating wealth has always involved some combination of risk and luck. This weekend, I had one high luck event and an unrelated opportunity for a high risk event.

My lucky event was that I went to the local casino, threw some quarters into a slot machine, and had it spit out 10,000 quarters. That's $2,500 for those of you without calculators. This is a nice boost to my bank account and to my overall poker fund.

My high risk event came in the form of another "use this check for anything" offer. They are providing me $8,500 at 0.99% interest for the next 6 months, or 6% APR for the life of the loan. Additionally, they will be charging a 3% fee.

While normally I discuss that these fees prevent any good use of the close to free capital, I think the stock market is at a point where I could invest short-term with the funds and make some good returns.

I will be spending the next few days hashing out the details here, and making a decision by the end of the week.

Posted by

Finance Guy

at

10:00 PM

5

comments

![]()

Labels: gambling, stock market, stocks

Tuesday, April 1, 2008

Networth Update - 6 month restatement

Wow, thanks to the watchful eye of a reader, I feel like one of the major banks, and I now have to restate my networth. Apparentally, I had been neglecting to count card #6 in my liability figures. Instead of calculating out exactly the amount for the past 5 months, I have gone back and subtracted $5,500 from each month's networth statements. For this month, I have now corrected to the correct networth. You can see these changes on my linear estimating chart on the bottom of this post.

Wow, thanks to the watchful eye of a reader, I feel like one of the major banks, and I now have to restate my networth. Apparentally, I had been neglecting to count card #6 in my liability figures. Instead of calculating out exactly the amount for the past 5 months, I have gone back and subtracted $5,500 from each month's networth statements. For this month, I have now corrected to the correct networth. You can see these changes on my linear estimating chart on the bottom of this post.

Month over month, I am still doing the same relative amount of growth in my assets, but of course, I am actually further from my goal than I thought.

My current netorth is -$11,875.79 or -1.19% from my goal. So rather than being 3 months away from positive networth, I am actually about 12 months away.

So rather than being 3 months away from positive networth, I am actually about 12 months away.

Posted by

Finance Guy

at

9:14 PM

0

comments

![]()

Labels: networth

Monday, March 31, 2008

Networth Update - Another month, another gain

This month saw huge drains to my bank account, as my 7-day cruise coincided with paying my parents back for their initial out-of-school loan to me.

This month saw huge drains to my bank account, as my 7-day cruise coincided with paying my parents back for their initial out-of-school loan to me.

However, this was offset by my tax refund and continued adherence to my budget.

Also, I've found myself using less cash on discretionary items, but finding that I have been spending more on food, and especially on coffee. I suppose sleep could help me save some money there.

Compared to last month, my networth is up 0.13% or $1,265.65.

Overall, this bring my networth to -$6,020.28 or -0.60% away from my goal.

On a side note, I am now designating Bank #2 as my emergency fund bank, since I use Bank #1 primarily for bills and checks, and expect the money in Bank #2 to accumulate interest.

Posted by

Finance Guy

at

9:39 PM

2

comments

![]()

Labels: networth

Wednesday, March 26, 2008

Socially Responsible Investing

Socially responsible investing is all the rage these days, with investors boycotting companies that exploit rainforests, emit high amounts of pollution, or have insensitive HR practices. While normally these types of "irresponsible" corporate behavior are items I don't consider, a recent proxy for my mutual fund got me thinking.

It read:

"Shareholder proposal for ... [list of fund names] ... concerning Board oversight procedures to screen out investments in companies that substantially contribute to genocide."Well that got my attention.

While I'm okay with minor corporate indiscretions, I was definitely curious as to how contributing to genocide could possible add value to a company. So as with any question I don't know the answer to, I did a Google search.

I found this page: "Investors Against Genocide". In the FAQ, they answer:

"Although federal law prevents most US companies from operating in Sudan, American financial institutions, in particular mutual fund companies, are major investors in the Chinese, Indian, and Malaysian oil companies involved in Sudan which are helping to fund this genocide."Essentially, the Sudanese government is taking the oil revenues generated and plowing it into its war effort, which explicitly supports the genocide they are committing.

Certainly I had no idea that such investments in genocide were occurring. The above website is worth checking out for any socially conscious investor.

I definitely am voting for this shareholder proposal, and standing up against genocide.

Posted by

Finance Guy

at

11:29 PM

2

comments

![]()

Labels: genocide, investment, mutual funds, socially responsible investing

Tuesday, March 25, 2008

Ameriprise Lunch

I think everyone in corporate America has had at least one free lunch from Ameriprise. Today's lunch was my second. For those who don't know, these lunches are typically a selling too for Ameriprise advisers who try to sell you on their services for the first 10 minutes of your lunch, and then leave you alone. They go away with your contact information and with the "threat" that you could be called.

I attend these type of lunches grudgingly; while free lunch is good, who has time during lunch to hear a sales pitch?

But today's lunch got me thinking. How much longer will these advisers be around for?

Most people who have significant wealth would not pick up a financial planner in such an odd fashion. I would think the target audience would be the middle to upper-middle class. Yet, with the huge rise in free personal finance blogs and the constant stream of free personal financial advice from conventional media, in 5 years, are people still going to pay for the advice?

Anyone with half a mind and access to Google could get pretty much any mundane personal finance question answered.

I would think their days are numbered.

Posted by

Finance Guy

at

11:33 PM

1 comments

![]()

Labels: personal finance

Monday, March 24, 2008

Bear Stearns and the Market

Sometimes, I wish I had more money when I see a sure thing. Last Wednesday, I blogged about the recovering markets, and the affect Bear Sterns' buyout offer had. Never did I think though that Bear would help as much as it has.

The market has not been up 4 of the last five trading days. Bear's stock is up 600% from JP Morgan's initial buyout offer. JP raised their offer 500%.

It's insane, and it continues to indicate to me that the markets are definitely due for full recovery by summer time.

The only thing now is if we can get the Fed to steady its hand, and stray away from more rate cuts, then we can ensure the gradual upward climb for the dollar, and the US economy as a whole.

Posted by

Finance Guy

at

9:53 PM

0

comments

![]()

Labels: stock market

Thursday, March 20, 2008

First Site Award

Well readers, thanks to your support and encouragement for my blog, someone out there has decided to give me my first official outsider review and rating.

Blogged.com gave this blog a 8.2 or Great rating.![]()

It has been fun blogging, and I will continue for some time.

Posted by

Finance Guy

at

10:52 PM

2

comments

![]()

Labels: award

Wednesday, March 19, 2008

Markets Recovering?

I have wavered back and forth on the outlook of the market, but I think this week's Bear Stearns announcement, coupled with the Fed rate cut and the huge positive reaction from the market suggest that the markets may be slowly getting back on its feet.

Let's break down the three situations:

1) Bear Stearns' stock, even with a clear buyout deal, orchestrated by the Fed, from JP Morgan has continued to climb from the buyout price of $2 / share to almost $6 / share today. This indicates to me that market participants are realizing the buy out is way too cheap, suggesting that people do have a bottom to their recession / subprime fears, and $2 is certainly way below it.

2) The Fed discount rate was widely believed to be 100bps, and by taking a surprising move of 75bps, showed the market two things. (1) The Fed has a backbone and is capable of making monetary policy without bowing to Wall Street and (2) The Fed believes we are in a better situation and therefore believes the additional 25bps is unnecessary.

3) Looking at the 3-4% increase in all major indexes, one has to ponder that the Fed minutes were all good news, and that market sentiment is veering to bullish.

What does this all mean in the end? I think we have another 2 months of the market's volatility smoothing out, and by early summer, it will be the right time to buy in again.

Posted by

Finance Guy

at

12:04 AM

0

comments

![]()

Labels: stock market

Sunday, March 16, 2008

Back from vacation

Posted by

Finance Guy

at

12:15 PM

2

comments

![]()

Thursday, March 6, 2008

On Vacation

I start vacation Friday afternoon, but this is going to my last post until the next Sunday when I arrive home from my Caribbean cruise.

In the mean time, thank all of you for reading my blog, and remember to check in again in a week!

Posted by

Finance Guy

at

12:47 AM

0

comments

![]()

Labels: vacation

Tuesday, March 4, 2008

Saving eletricity while single...

...is tough to get into the habit of doing, but the savings add up quickly.

Recently, I had blogged about not running the humidifier running while I wasn't home. That saved about $20 in electricity. Then I thought about the appliances that I have on that don't need to be on. I really only had two other items, my router and cable modem. I've been turning those off and seeing what that does. If I see another $20 decrease in my bill, it would be worthwhile.

I have also switched out most of light bulbs to energy saving light bulbs. I will be getting my electricity bill soon, so I will soon be able to quantify the value.

Posted by

Finance Guy

at

11:42 PM

0

comments

![]()

Labels: energy savings

Saturday, March 1, 2008

Networth Update - 2.22% pts closer to my goal this year