Folks, its been an interesting year.

I have enjoyed blogging so far and will continue this blog next year.

As I ponder the next few days, I realize I should take time off to focus on family and celebrating the New Year, and leave the world of personal finance behind... for a little while.

Come the first week of January, expect my December '07 networth status, and a complete analysis of my spending pattern for '07. I will also be looking at my spending and searching for ways to save more.

I have yet to arrive upon a new year's resolution, but suffice to say, I started really doing resolutions two years ago, and I have stuck to both of them: (1) track all expenses, and (2) get a job. On the top of my list of course are the usuals: win the lottery, learn to dance, and get healthier. There are also realistic ones, like pass a CFA test and get a promotion. Again, I don't really know, so be ready for that in the new year.

Otherwise, New Year's Eve should be interesting. I've shelled out $200 to try an all-inclusive nightclub outing in NYC. If I can avoid the Irish flu, I'll be back to work Jan 2.

Hope you all have a safe and happy time partying.

PS - Don't spend TOO much!

PSS - And that's the last personal finance advice I'll give this year.

Saturday, December 29, 2007

Goodbye until the New Year!

Posted by

Finance Guy

at

5:29 PM

0

comments

![]()

Labels: happy new year

Thursday, December 27, 2007

Rally Assassinated

Nothing ruins the economy more than social strife. Nothing could have been worse for the Santa Claus rally than the assassination of Benazair Bhutto, former Pakistani prime minister and leading candidate for this year's election.

With her death, I find myself in an odd place. First, this is my first foray into politics on this blog. Second, it significantly increases the uncertainty of the future, and therefore can only negatively impact the global economy, and as a result, global stock markets.

My politics and economics are always tied together. At a time when the US is gearing up for its primary elections, political unrest around the world will greatly weigh on the minds of average citizens, far more than usual. This will cause voters to consider strengthening our terrorism "war", and thus risking increased anti-US sentiment, which will result in decreased business.

Rather today's news will impact the market for long-run remains with how Mussaraf deals with the riots today, and what he does about the coming elections. I expect martial law to be declared and elections to be postponed. This is the predictable outcome and would calm markets.

However, if Mussaraf proceeds, then any election result will cause massive turmoil in the country, and fears will run rampant for at least the next month, devestating our struggling stock market.

Posted by

Finance Guy

at

9:55 PM

0

comments

![]()

Labels: bhutto, mussarf, stock market

Wednesday, December 26, 2007

Santa Claus Rally: Can you ride along?

Now that we're in the stretch between Christmas and the New Year, we are officially in the span in which an annual market phenomenon occurs: the Santa Claus rally.

Today was a good, if mild, start to the rally, with technology (and the Nasdaq), leading the way. From now until year end, I'd expect technology and financial services to rise, as they have been the hardest hit.

The big financials still have a huge hole to dig themselves out of. However, I think their future is bright. While they cannot continue making obscene amounts of money from subprime mortgages and the securitization market, they will still truck home cash to every investor.

For this reason, I bought XLF today. XLF is an ETF index of financial stocks, with big names such as Merril Lynch, Goldman, Bank of America, and Citigroup. This ETF has been hammered this year, losing about 17% of its value. I foresee a bounch back in most of the financials within a year.

And of course, my consistent favorite QQQQ (ETF of Nasdaq), continues to be another recommended buy.

Posted by

Finance Guy

at

9:32 PM

0

comments

![]()

Labels: stock market

Thursday, December 20, 2007

Increased liquidity eases fears

Not out of the woods yet, but the extra money being pumped into global corporations is helping to ease market fears.

Markets had another V-shaped day, centered around noon. I've been basing my strategies on that recently. Around noon US EST, England's markets close, and it seems to drive US markets down. As the afternoon rolls around, they go right back up. Its been two days of this (and many times over the last 5 months), and there's no particular reason to believe this won't continue.

For anyone who trades in indexes, this kind of predictability is a real money maker.

Posted by

Finance Guy

at

12:59 AM

1 comments

![]()

Labels: stock market

Wednesday, December 19, 2007

Markets Looking Better

After $500 billion infusion of credit from European banks, markets across the world are starting to do better. Maybe the Santa Claus rally will occur after all.

With the market in so ridiculous flux, it is difficult to suggest any good plays in the near term.

In the long term, the markets will get better, so continue buying up those banks and technology stocks that have suffered greatly in the past weeks. In 2-3 months, the markets be much more stable, and those stocks will be back.

Posted by

Finance Guy

at

1:10 AM

0

comments

![]()

Labels: stock, stock market

Monday, December 17, 2007

Option FAQ, Part 2: Hedge it to Me!

Last week, I began this Option FAQ with a basic introduction to options. In part 2, I will delve more into more advanced hedging functions.

The first hedging function I discussed last week was to put a floor on stock value by buying a put option. Now let's consider the reverse, selling a put.

Selling a put means you are providing someone the option to have their stock purchased from them, by you. This is the opposite of buying a put, and is similar to shorting any given stock (including requiring margin). What does this look like? This chart is the mirror image from the basic introduction image. Blue represents the stock price, while the red line represents a Jan '08 Put Option @ $700 that you have sold while you hold Google stock.

This chart is the mirror image from the basic introduction image. Blue represents the stock price, while the red line represents a Jan '08 Put Option @ $700 that you have sold while you hold Google stock.

As the graph shows, by selling a put option, you have created a ceiling for your portfolio.

Now lets talk about call options.

Call options provide the ability to buy an underlying equity. If you buy a call, you are purchasing the right to buy an equity at the specified price. If you sell a call, you are selling the right to buy from you an equity at a specific price. So what do calls and stock look like for your portfolio? I'm going to teach you to work it out for your self with fancy term called "Financial Engineering".

Technically, this is the design of various financial products that decrease external risk, and help you get a financial instrument with the exact risk you are looking for. As applied to options, this is like putting puzzles together.

Let me decompose those portfolio value charts that I have made, and provide you with what each option type actually looks like:

Now you've seen me combine stocks with the put options for portfolio value, so I will walk you through a combo stock + sell call. Remember a stock follows a diagonal line. So let's put these two lines onto one graph.

Now you've seen me combine stocks with the put options for portfolio value, so I will walk you through a combo stock + sell call. Remember a stock follows a diagonal line. So let's put these two lines onto one graph. (Due to spacing issues, the graph I'm referring to may be lower on the page) The blue line is Google stock, the red line is the option, and the purple line represents the combination of the two. As you can see, prior to hitting the strike price, a combination portfolio has more value than the stock, primarily because of the money received for the sell of the option.

(Due to spacing issues, the graph I'm referring to may be lower on the page) The blue line is Google stock, the red line is the option, and the purple line represents the combination of the two. As you can see, prior to hitting the strike price, a combination portfolio has more value than the stock, primarily because of the money received for the sell of the option.

Past the strike price point ($700), the portfolio value flattens, while the components head in different directions.

This is the basis of a hedge. You want two instruments that move in exact opposite directions.

Now go out there and play with each of the four option possibilities, and we'll discuss the tried and true options combinations.

Posted by

Finance Guy

at

10:52 PM

0

comments

![]()

Labels: options

Sunday, December 16, 2007

Behind the scenes: What's in store for this blog

The 10 months that I have been blogging has been an incredible time for me. I wanted to take this time to reflect:

First and foremost, blogging has really provided me a forum to increase my own understanding and application of financial theories to practice. In every post, I attempt to provide the most accurate advice/comment/suggestion through intensive research. This research has certainly enriched me.

Second, the blog has changed slightly from its original purpose. I started the blog to attempt to catalog each new personal finance issue I was faced with and then to give readers my solution. However, as I finalized my move from college life to real life, I realized there really wasn't going to be such a regular plethora of personal finance issues. I grappled with three possibilities: only posting when I had a new problem, start blogging about mundane PF issues, or start branching out into my investments. I settled upon investments because it provided the most regular material to blog about, and investments are a huge part of anyone's personal finances.

Third, as the new year begins, and as my blogging experience increases, I will begin blogging in a more organized fashion. I will start having mini-series on PF and investment issues, delving deep into a problem for a week or two.

The first of these series I started last week on options trading. I will work hard on fleshing out this topic for the next 5 days.

Posted by

Finance Guy

at

6:13 PM

1 comments

![]()

Labels: blogging, personal finance

Thursday, December 13, 2007

Bogged down with work

Per the norm, overloaded with work = getting colds. Sick as a dog and still working.

These crazy volatile market days aren't helping.

Upward trend continues, but roller coaster rides are getting more and more dangerous.

Posted by

Finance Guy

at

12:20 AM

0

comments

![]()

Labels: stock market

Wednesday, December 12, 2007

Wow, that hurt

A very unexpected move yesterday by the Fed. 25bps cut for both the Fed Fund target rate and the discount window.

The market just jumped off the edge into oblivion after the announcement. However, I don't believe that 25 rather than 50 bps to the Fed Fund target rate is really the big issue. Instead, I think its the 25 rather then the expected 50bps cut in the discount window that really caused the issue.

There is a large credit problem for banks right now, and a 50bps cut would have allowed them to get that credit cheaply.

In the coming days, the clear market reaction is that more cuts are needed, and the Fed looks poised to respond. I think the market will rally again before the year is over.

Posted by

Finance Guy

at

12:59 AM

0

comments

![]()

Labels: stock market

Monday, December 10, 2007

Wait and see

Today's market was upward trending, yet cautious. Why? Everyone is still waiting to see what the Fed will do. 25bps is in the bag. 50bps? Maybe.

Tomorrow is a day to ride it out until 2:15pm. Then, the market will almost certainly see a big bump, followed by a drop either a few hours later or the day after.

The best way to play tomorrow is to take some gains quickly, especially short-term bets, but hold on to long-term bets, as the economy is definitely turning for the better.

Posted by

Finance Guy

at

8:46 PM

0

comments

![]()

Labels: stock market

Two Words on the Market this week: Cautious Enthusiasm

It's coming.

Not Christmas, Santa Claus, or even the Easter Bunny.

This is much bigger.

On Tuesday, the Fed is set to announce its decision on interest rates. The question for the last week has been of "How much?". Most of would say 25bps would be on target, while 50bps would show the Fed trying to get ahead of the market.

After last Friday's excellent job data, there is less of a chance for a 50bps cut.

So what are the plays for the week? I think regardless of what level of a cut, the market will have a positive bounce for the week. I am still a huge fan of high-tech, as well as retailers, and even banks for the long run.

Posted by

Finance Guy

at

12:03 AM

0

comments

![]()

Labels: stock market

Thursday, December 6, 2007

Options FAQ, Part 1: What art thou?

Recently, a reader asked for more discussion of what an option is, how to trade it, and how it has value. As an short-term options trader, what I present here is not necessarily how I make money, but rather, what the option product is typically used for.

Part 1: What are thou?

What is an option? To pull a cliche, I will quote from a dictionary (Wikipedia):

"Options are financial instruments that convey the right, but not the obligation, to engage in a future transaction on some underlying security."What does that actually mean? In high finance, every contract involving money is a "financial instrument". It merely means money is involved. A security is kind of contract or product that is traded for money.

So essentially, Options are financial contracts that give the right, but not the obligation, to trade a product for money. An options primary purpose was to hedge a bet. We'll get to that soon.

Options have 4 fundamental characteristics:

- type of option

- strike price of option

- expiration date of option

- underlying security (asset).

Next, let's choose an option type. There are two, calls and puts. Calls give the option to buy. Puts give the option to sell.

But at what price can we choose to buy/sell? That's the strike price.

Finally, option contracts have expiration dates, typically at most 12 months as a time.

Now that you know the basics, how can you use it to hedge your stock portfolio?

Say you own 100 shares of Google at today's close price of $715.26. You're fairly certain that in the next month, Google stock will rise, but you want to guarantee that you get at least $700 for your stock.

What do you do?

You can buy one (1) Jan '08 $700 Strike Price, Google Put (typically, options are traded in 100 contract blocks, so buying one = 100 contracts). The current price of each contract is $22.80, which makes this put option worth $2,280. Let's look at a graph to see how this can be useful:

The x-axis is the value of Google stock, and the y-axis is the value of each stock in your portfolio.

The x-axis is the value of Google stock, and the y-axis is the value of each stock in your portfolio.The blue line represents ownership of the stock. The value of the stock to you increases and decreases in a 1 to 1 ratio with the actual stock.

Now, with a put option, indicated by the red line, the value of each stock can not drop below $700 a share, because if it does, you can exercise the contract, and sell your shares at the strike price. In effect, buying the put option has guaranteed you a floor, or at least, $700 / share.

Is spending $2,280 worth locking in at least $70,000? It depends entirely on what you believe is the chance that Google stock will decline, as well as how much money you want to make on this trade. A simple way of thinking about it, is that the money is spent to insure your asset.

For now, this is a very basic introduction to the classic use of options to hedge a portfolio. The next part will focus on more advanced hedge functions.

Posted by

Finance Guy

at

10:32 PM

1 comments

![]()

Labels: hedging, stock options

Wednesday, December 5, 2007

Market Thoughts

It was a positive day today, with economic indicators showing the economy is not nearly as bad as people have been thinking. Frankly, I have been of this opinion for a while now, but I still think there is plenty of fear out in the market, and its still very much a wait and see situation.

For those risk takers out there, I would start buying up cheap stock ahead of the Fed rate cut announcement.

Another respected economic indicator will be released tomorrow: jobless claims. Although typically this does not have a great affect on the market, the mass hysteria in the market could take a spike in claims as a negative sign and just crash. Just as likely however, is a spike downward, causing continued faith in the market.

Posted by

Finance Guy

at

11:03 PM

0

comments

![]()

Labels: stock market

Tuesday, December 4, 2007

A light dusting, icy roads; use caution

Ever think a weather forecast could provide market advice? This week's has.

Monday I woke with a terrible cold and promptly went back to bed. I woke late in the afternoon to realize that the market was stumbling like an out of work writer (when does a writer ever have work?), after a night's worth of "inspirational" drinking. It weaved back and forth, back and forth, finally settling down on the curb to mull the comfortableness of gravel.

There we found it Tuesday as well. And the weather forecast popped back into my mind. After snow, there are two types of weather: incredibly bright and sunny, or days more of ice and snow. That's where the market is right now.

We all know salvation is at hand. Next week, the Fed is going to cut rates again, perhaps by 50 bps, but almost certainly by 25. But this week, we're still suffering from subprime-November, with the financial companies all getting rating downgrades.

Week outlook? Icy roads, use caution.

[Edit] I have also received reader feedback that they wish to be walked through a real example of option trading. I will be working on that for posting by the end of this week.

Posted by

Finance Guy

at

10:29 PM

1 comments

![]()

Labels: stock market, weather

Saturday, December 1, 2007

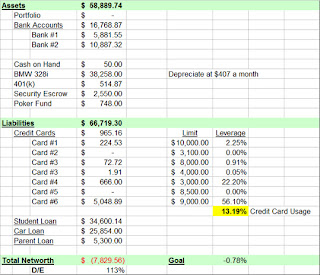

Networth Update

I am so incredibly excited about my networth this month, that I have chosen to stay awake after a night at the casino in order to update it!

I am so incredibly excited about my networth this month, that I have chosen to stay awake after a night at the casino in order to update it!

This month saw my security deposit returned to me, and the opening of a Roth IRA savings account. Also, increased poker activity helped to offset some living expenses.

Compared to last month's networth update, I have seen a 0.28% increase in my networth, or an increase of $2,821.96.

I am incredibly happy with this growth, as if this trend continues, I will be in the positive networth range by the end of January. Then come tax season, I expect huge tax refunds because of my over-taxed sign-on bonuses, and also because I have been taxed as someone working for the whole year, rather than the 75% of the year that I have actually worked.

This brings my networth to -$5,007.60, or -0.50% toward my million dollar goal. Since there have been enough months, I am also including a bonus chart of my networth progress since I started blogging in March '07.

Since there have been enough months, I am also including a bonus chart of my networth progress since I started blogging in March '07.

This graph also shows my monthly trend, which is to increase my networth by about $2,400 a month on average.

Posted by

Finance Guy

at

4:11 AM

0

comments

![]()

Labels: networth

Friday, November 30, 2007

Hidden Fees at Chase

Recently, I have been moving my assets around to different banks, seperating out what I consider temporary versus permanent cash.

My Chase account is the primary receiver of money, and from there, I distribute the money to my investment accounts, credit cards, etc. While this has been successful, I had wanted a better method to transfer funds between accounts in different banks rather than writing checks and walking into brick and mortar facilities to cash them.

I saw that Chase offered online transfers, and thinking they were the same as the e-bill pays I had been performing, I linked my Citi account to my Chase account. I then went through the procedures and transferred $1,500 in my Citi account.

After two days, I noticed a $3 fee related to the transfer. When I called Chase, they promptly told me that:

- There was a fee to transfer money online

- I agreed to the fee in some jumble of legal disclaimers (who ACTUALLY reads them?)

- The price is stated in small font somewhere on the website

Of course, per the norm, banks can nickel and dime you out of anything, so after about 30 minutes, I gave up on getting my $3 back.

But it angers me that the fee is equivalent to a 0.2% charge on moving my OWN money around.

Watch out for these so-called "conveniences" in your online banking activities.

Posted by

Finance Guy

at

2:44 PM

0

comments

![]()

Labels: banking

Thursday, November 29, 2007

Market Outlook and End of the Year projections

Today started disastrously, with a major block of crude oil pipelines shut down due to an explosion. This scared the Street in the pre-markets, but as the smoke cleared, things seemed to settle down. There was no sign of terrorist activity, and 2 of 4 pipelines were immediately brought back online.

Throughout the day, the market continued to seesaw, dragged down primarily by higher than expected jobless claims and lower than expected new home sales.

The market ended up slightly ahead.

Tomorrow's outlook? Bright. The Asian markets are doing well, and hopes of Fed rate cuts remain. The correction downward in oil futures have also decreased inflationary fears. Technology especially is coming out of the dog house, as more investors realize the great bargain buys that exist (Amazon, Microsoft, Cisco).

I have been keeping track of some financial stocks that I believe are great bargains such as E-Trade Financial (ETFC) and National City (NCC). I own about 350 shares of E-Trade and plan to buy National City options tomorrow.

For the rest of the year, I see positive impacts for a Fed Cut, and also normal holiday cheer in the market, resulting in the Dow closing likely above 14,000.

Posted by

Finance Guy

at

10:25 PM

0

comments

![]()

Labels: predictions, stock market

Wednesday, November 28, 2007

Finally, a PF post

It has been a while since I've blogged a real personal finance post, so I'm going to try this again.

Recently, I've finally put into place my free and no-risk interest income from debt.

Having read enough of these posts on other blogs, I know its going to start off looking like another convoluted get-rich quick scheme. It is not. This is neither quick nor easy.

- First off, you need to have good to excellent credit.

- Second, credit companies or banks must be willing to lend you money at no interest for anywhere between 6-12 months.

- Third, you have to know a bank willing to give you a reasonable 3-5% interest rate.

- Finally, you need to be able to handle a sizable debt load without any large debt needs in the near future.

- Credit card company X sends you a letter: "You can get $Y amount of money to pay off your other credit card bills for Z months for 0%"

- Say you are given a $10,000 line of credit for 6 months at 0%.

- You find a bank willing to give 4% APY.

- You take credit card company X's loan and deposit into the bank for 6 months.

- At the end of 6 months, you have collected $200 in interest.

- You empty your bank account, pay back the $10,000, and keep the $200 for yourself.

Ironically, as you take on more debt load, you'll get even more debt offers. These interest payments start small, but it is not unheard of for the debt load to go up to $100,000 to $200,000 at a time.

Given the same 4% APY for 12 months on $200K, that's $8,000 a year for free.

Now who can't use $8,000 a year more?

Posted by

Finance Guy

at

6:53 PM

0

comments

![]()

Labels: credit cards, debt

Tuesday, November 27, 2007

The beggining or a fluke?

With the ridiculous volatility of the market these days, was today really a result of Citigroup's $7.5 billion cash infusion (really a regular corporate bond sale) which has completely wiped out all subprime fears or is today another example of daily short-term market reactions that has characterized the last month of market movements?

Around midday, I was ready to believe in my own cynicism. The market started plummeting, sputtered out, see-sawed, and then dropped for a while. An hour before the end of day, the market caught itself and shot up to close near the day's highs.

While I'm not a 100% believer in the technicals, I do believe that a study of market movement does give a good indication for what the market is thinking in the short-term. In my mind, such a dip was initially caused by investors who had been holding their breath for a long time to see just their investment come back, followed by the uptick representing other investors who finally saw a bottom and realized just how oversold the market really is.

At the same time, another data point related to the subprime market will be released tomorrow, existing home sales. This could have an adverse affect if the trend is sharply downward.

Posted by

Finance Guy

at

8:41 PM

0

comments

![]()

Labels: stock market

Sunday, November 25, 2007

Fat from Turkey day, the Street may be in the same upbeat mood

Going into the Thanksgiving weekend, I was worried about when the market would snap out of its rut. For a while, the market has worried about the declining value of the dollar, rising gasoline prices, and overall economic sluggishness.

The last trade I made last week was to buy more Nasdaq QQQQ Dec '07 options at 51 on the belief that Thanksgiving weekend retail sales would be both great and the news the market needed to get out of its rut.

So far, half of that has come to fruition. The numbers from this past weekend have been good (article here). Now I hope Wall Street will respond in kind, and really get the magic back.

Update: Asian markets are upbeat on this retail news, so Wall Street seems more likely to follow suit.

Posted by

Finance Guy

at

10:04 PM

0

comments

![]()

Labels: stock market

Monday, November 19, 2007

Gobble Gobble

The market is looking sluggish, but frankly, I'm going to check out for the rest of the week and ride out the waves over some turkey. The market is volatile, and people are repeating the big R-word (recession). But I really think people just need time to think, and they'll realize the economy isn't as bad as people think it is.

Posted by

Finance Guy

at

9:10 PM

0

comments

![]()

Labels: stock market

Quick and quiet, with a chance of showers

This week is going to be a shortened trading week, with most traders worried more about where the turkey is coming from than where the market is going. Expect trading to be light, and market direction to waver, rather than trend one way or another.

Posted by

Finance Guy

at

7:04 AM

0

comments

![]()

Thursday, November 15, 2007

Market Hiccup, CPI Numbers to Come

The market took a little hiccup at the end of day, although throughout most of the day, it was in the black on good inflation news. More inflation news is expected tomorrow with the release of CPI numbers. Tame inflation will be good for the market, as inflation fears have been one of the primary reasons the Fed refused rate cuts in their last meeting. The next meeting is scheduled Dec 10, and many are looking for another rate cut to get the economy and the market back on track.

Posted by

Finance Guy

at

12:14 AM

0

comments

![]()

Wednesday, November 14, 2007

Tuesday, November 13, 2007

Hell has frozen over: Walmart reigns supreme

What an unbelievable day on the street!

Dow up 319. Nasdaq up 89, and S&P up 41!

Just insane. And what caused all of this?

Well, it all started with Walmart. That's right. Today, Wall Street cared completely about what was happening on Main Street, and on Main Street, Walmart had made a better than expected profit off of what many considered a dismal quarter for retailers.

Why did I mention hell freezing over? Because never in a million years did I think that one day I would say to myself "Thank God for Walmart", but I did. And now let's put it behind us and never speak of it again.

The rest of the day was a parade of major banking institutions' CEOs giving their view of the credit markets, led by Lloyd Blankfein, CEO of Goldman Sachs, who announced that Goldman going to have an significant write-down of its assets.

My outlook is that this new found exuberance will last until at least Thursday. Friday will be a tough day as options will be expiring, and there always tends to be a downward trend on expiration days.

For the next few weeks, volatility is still high, but if oil continues to fall and the dollar continues to strengthen, I predict we can see a resurgence of the Dow getting close to the 14000 mark again by year end.

I certainly have money riding on that.

And because I haven't done this in a while, please note my disclaimer, which is also on the bottom of every page on my blog:

Disclaimer: I am not responsible for any financial and/or personal situations that arise from information in any of my blog posts. Financial advice is given to the best of my knowledge, which may or may not be accurate. Stock picks and stock market analysis should be considered 100% bias, as I will obviously talk about good/bad picks that I personally may or may not be considering/holding.

Posted by

Finance Guy

at

11:17 PM

0

comments

![]()

Labels: dow, goldman sachs, oil, stock market, us dollar

Sunday, November 11, 2007

Super Busy + Market Fears = Losing Money

The past week, I just could not find time to blog, nor really stay abreast of the market, other than watching my portfolio drop in value.

I hope to remedy both of these situations this week.

Last week, the markets crashed on continued subprime mortgage fears from the major banking institutions (how much more loss are they hiding?) on top of rising oil prices (nearing $100/barrel), and the related issue of the falling dollar.

I would love to say that I believe we've reached the bottom, and certainly my options would love it if the market was ready to go up, but there is a good chance that early this week, we'll still see market jitters, with the market smoothing out, and maybe rocketing higher by the end of the week.

One important piece of economic news will be released this week that will have a major impact on the market: retail sales figures due on the 14th.

Posted by

Finance Guy

at

11:11 PM

0

comments

![]()

Tuesday, November 6, 2007

The Market Always Likes Going Up

It's really true. The market enjoys upward trends and abhors downward trends. No real economic data came out today to support such a market bump, but it occurred anyway. This is why buying on lows (bargain hunting) is a rule of mine, and a rule that many investors follow.

The tough part is trying to find the right time to buy during an upward trend time, or mixed weeks, such as this week.

My suggestion? Stay out until the end of November. The markets are extremely volatile, and if you aren't in already, wait it out.

Posted by

Finance Guy

at

9:26 PM

0

comments

![]()

Monday, November 5, 2007

Shitty Citi

Why oh why! Citi was supposed to fire Chuck and call it a day. That would have propelled the stock upward.

Instead, they went with a bloodbath, and bam, the market tanks, Citi stock tanks, and the whole world has decided to be in worry mode.

My hope? The market loses some fear, and people realize how good of a deal Citi is now.

Posted by

Finance Guy

at

10:19 PM

0

comments

![]()

Friday, November 2, 2007

Unbelievable day in the market!

So I suppose there was one scenario I should have offered up yesterday, that both crazy up and crazy down would occur, which would cause the market to fluctuate back and forth all day, ending in the green across the board.

Two big pieces of news came out of today:

(1) Citigroup's CEO Chuck Prince is expected to resign Sunday! This should result in a nice bump for the stock, considering so many people have thought most of Citi's problems have been Prince's leadership.

(2) Merril Lynch has been engaging in some shady off-balance sheet deals with hedge funds to put off losses to a different time. This resulted in a 7.9% drop today, and most likely continued losses next week.

Posted by

Finance Guy

at

6:43 PM

0

comments

![]()

Labels: stock market

Morning update

Pre-market looks green, but only barely, so its a tough call. Can still go either way.

Posted by

Finance Guy

at

6:29 AM

0

comments

![]()

Thursday, November 1, 2007

There is no fury like a stock market scorned

Wow! Just WOW!

Today was one of those days that as soon as I woke up and stubbed my toe, I knew it would not be a great day. Throughout the morning, bad news was coming left and right.

First it was Citigroup. Analysts from CIBC downgraded Citigroup, citing fears about continued fallout from the subprime mess caused the big C to tumble 6.58% or loss about $14 BILLION in market cap. This also prompted concerns across the entire banking sector.

Then, Exxon Mobile reported a 10% decline in profits.

Throughout the day, the market fell like a concrete airplane filled with concrete little people all hoping to get on the ground as fast as possible.

And on top of that, CVS announced a great quarter and its stock price still plummeted 1.5%.

So, what will happen tomorrow? There are really two possibilities I can think of:

(1) The market will stay in its death spiral, feeding off of today's loss and the Asian markets reactionary drop to continue falling.

(2) After one of the biggest losses in the Dow in months, bargain hunters see an excellent opportunity to buy in.

Option (2) is definitely very optimistic, but barring any good economic news, i think the chances are 70/30 for option (1).

Posted by

Finance Guy

at

8:05 PM

0

comments

![]()

Labels: stock market

Wednesday, October 31, 2007

Networth Update

An interesting transition month has come and gone, and its time to update my networth again. This month was an exceptional month in terms of my finances, since I collected a vacation pay out from one place and then a sign-on from another.

An interesting transition month has come and gone, and its time to update my networth again. This month was an exceptional month in terms of my finances, since I collected a vacation pay out from one place and then a sign-on from another.

Besides the extra income, my expenses this month has been surprising in check (minus the obvious fund I set aside for buying new furniture for the place).

So, compared to last month's networth update, I have seen a 0.96% increase in my networth, or about $9,600.

Obviously, every month is not going to be like this. However, I am steadily progressing toward my goal, and I predict I'm about 8 months away from the break even point, where my liabilities will equal my assets.

Posted by

Finance Guy

at

9:27 PM

0

comments

![]()

Labels: networth

Go Go Fed

The Fed announced a 25bps rate cut today, which is great news, and the market was definitely looking for it. But, interestingly, the market in the 5 minutes after the Fed's announcement tanked. Why?

Hidden in its announcement was the indication that the Fed would most likely not cut rates in the near future, citing concerns with inflation (look at the high price of gas) and the overall stability of the economy.

So what are the plays for the rest of the week? Well, if you got a nice bump today, my suggestion is to sell 50% of your winning positions to lock in your profits, and then maybe wait until Friday to completely unwind. The market tends to take profits after these bumps, and you should do the same.

However, there is one stock I was buying today, CVS. They are announcing earnings tomorrow, and I would have posted this pick earlier, but I had completely forgotten about their earnings release date. But with the consumer goods report today being so good, its a great indication that CVS's earnings will also be amazing.

Posted by

Finance Guy

at

9:18 PM

0

comments

![]()

Labels: federal reserve, stock

Tuesday, October 30, 2007

Still waiting...

The Nasdaq did okay today, but really, it's still waiting for the Fed to tell the market "Rate cut!" There's very little change for a 50bps cut, but that would be amazing.

My portfolio right now is doing okay, since the Nasdaq has been up, but my bet on Amazon has yet to pan out. My attempt to catch a market inefficiency is butting heads against another classic market issue, no matter how wrong the market is, if the market wants to go there, you can't fight it.

So far, my Amazon options have lost 50% of its value, which is about $1,300. Hopefully the Fed's rate cut will help boost the stock some, at least enough for me to recover what I put in.

Posted by

Finance Guy

at

11:44 PM

1 comments

![]()

Labels: stock market, stock options

Monday, October 29, 2007

Here Fed, Fed, Fed...

Show me that rate cut!!

The markets are up a bit, but now the market has completely priced in a 25bps cut, which is what worries me. Once the market believes one way, and what is expected doesn't happen, there will be a HUGE drop. Conversely, if it does happen, the market will move a little bit.

This is a simple situation where the risk is high and the reward is low; a situation that is completely out of whack.

I am hoping for the best, but bracing for the worst tomorrow.

PS - End of the month is coming, and this month should see my networth move quite significantly, thanks to vacation time buyout from the old company, and sign-on bonus at the new company.

Posted by

Finance Guy

at

8:45 PM

0

comments

![]()

Labels: federal reserve, o, stock market

Sunday, October 28, 2007

Market Outlook for the Week

The Fed meets Tuesday, and most of the market is awaiting a rate cut decision. Most believe a 25bps cut, although 50bps isn't completely out of the question. It's probably going to be the biggest factor affecting the markets this week.

On the one hand, with rising gasoline costs and the fear of inflation, the Fed may decide to keep rates where they are, on the other hand, and what most believe, the Fed needs to stimulate the market and the economy by loosening the credit markets, and a rate cut is exactly what it needs.

Posted by

Finance Guy

at

8:43 PM

1 comments

![]()

Labels: federal reserve, stock market

Wednesday, October 24, 2007

Market down, portfolio up

Now most who read that headline would think, "oh, you were shorting the market", but no. I was actually long all day today. How then could I make money today?

Well one, I followed my own rules yesterday and sold half of my positions for a nice gain. This morning, as the market reacted to Merrill and Amazon's announcements, I realized it would be a big up and down sort of day.

I kept track of the market as it dipped, and around 11am, the market seem to bottom, so I bought in. I bought both the Nasdaq Qs as well as Amazon stop, for basically the same reason. Technology stock I thought were being hit by a combination of profit-taking from the day before and a general feeling market sluggishness. I thought that the market was over reacting.

After lunch, I patiently watched the market fluctuate a little before inching its way up. I was happy to see the Nasdaq end up even and Amazon make some of its 17% decrease back.

What do I expect tomorrow? A lot of bargain buyers will be coming in to scoop up the cheap stuff, and the market so do well.

Posted by

Finance Guy

at

9:35 PM

0

comments

![]()

Labels: options, stock market

Monday, October 22, 2007

Sigh of Relief

As Apple announced their ridiculous amazing earnings (news here), and Microsoft poised to report their earnings on Thursday, the NASDAQ made the turn for the better as I had hoped (predicted?). The fed comments today also helped, implying that a rate cut will definitely be used if market conditions worsen.

Overall, my position is still down about 5% from where it was last Thursday, but after hours trading suggest my options so all be in the black by the time the market opens tomorrow.

Posted by

Finance Guy

at

11:41 PM

0

comments

![]()

Labels: economy, options, wall street

Sunday, October 21, 2007

Market Outlook for the Week

Well, all the interesting earnings reports are behind us. The markets really took a beating late last week, as companies across the board reported earnings below or only meeting expectations, which the street hated (the only bright spot being Google).

For me, it was a great time to buy more Nasdaq (QQQQ) calls options on the cheap. Right now, I have amassed the largest position I have ever taken in one equity, about 25% of my total funds. It is a massive bet, but I am betting that the market well view the market this week with new eyes, see plenty of buying opportunities, and price in a rate cut coming after all this negative economic news.

What do I need? I need the Nasdaq to go up about 5% from where it closed on Friday, and my options will do very well.

Go Nasdaq!

Posted by

Finance Guy

at

11:35 PM

0

comments

![]()

Friday, October 19, 2007

End of Week 1

It's been a great week of work. First day was the usual, twiddle the thumbs and wait for things to be set up. Tuesday and Wednesday were tied up in a sales conference meeting I was invited to. Thursday and Friday, I continued twiddling my thumbs, and I only got some real stuff to do around 5PM today. But by then, its quitting time.

My new job is a 3-year finance rotation program. I'm going through my first rotation as a regional financial office for both the New England and New York regions, while also performing some strategy work for both.

This program should allow me to round out my financial expertise, and prepare me for any financial management job, and eventually, CFO of a company.

Posted by

Finance Guy

at

11:40 PM

0

comments

![]()

Sunday, October 14, 2007

Moved in and Ready to Start Work

Spent the weekend officially getting the last bits of my life into my new apartment. Now that I have my desktop setup and internet running, its time to tally the cost of moving. My guess is its going to be about $400 along with about $3000 scheduled for apartment furniture and upgrades.

Posted by

Finance Guy

at

6:40 PM

1 comments

![]()

Tuesday, October 9, 2007

Total's trades net me $400+

As a short-term trader, one of the things I love are news events that are guaranteed to move the market in some fashion. Events such as those allow me to bet one or the other, and the leverage of options really allow me to profit off of those quick moves.

Today is a good example. I knew early today that the minutes of last month's Federal Reserve would move the markets. Traders and analysts would be scrutinizing every word to see if another cut was on the horizon.

Feeling optimistic, I bought 30 October 53 QQQQ (Nasdaq-100 Index) Calls and 15 November 54 QQQQ Calls, as well as 10 October 158 SPY (S&P 500 Index) Calls. Around mid-day, the calls were about even, but the market had been fluctuating up and down for a while.

Right around 1:30PM, 30 minutes before the minutes were to be released, volume picked up, and the price started to trend upward. After the news was announced, that all the Fed governors were unanimous on the rate cut decision, the Nasdaq actually went negative while the S&P continued upward.

I wasn't phased. It always takes a bit of time for the market to digest Fed news.

By about 3:30, the frenzy started, and both Nasdaq and S&P ended up, pushing my Qs and SPYs to, so far, a $414 gain. I expect another good day tomorrow, but I will sell off some to decrease downside risk. By Thursday, I plan to dump it all.

Posted by

Finance Guy

at

10:12 PM

0

comments

![]()

Labels: federal reserve, options, trading

Monday, October 8, 2007

Apartment found, sold, and moved all in one weekend

I officially start at my new position on Oct. 15, which meant I had to find someone to take up the rest of my lease, find a new apartment, and me moved prior to October 15. Somehow, I managed to do all that this weekend, even though everything came down to the wire.

For a while, I was contemplating forgoing the $2500 security deposit, figuring my sign-on bonus and better job satisfaction would more than make up for that small financial hit.

Thankfully, I'm getting that back. Add to that my relocation bonuses and my old company paying me for unused vacation time, I've got some large checks coming.

My plan is to save a large portion of it, but still have money to buy a new LCD TV and a cheap sofa set.

At the same time, I have to come to grips with living by myself, which means I pay for 100% of the utilities, rather than the 3-way split I had. For utilities like cable, that was a great deal. For now, my way to cut back is to decrease my monthly discretionary budget, until I see how much utilities actually end up being, and then I can readjust accordingly.

Posted by

Finance Guy

at

11:09 PM

0

comments

![]()

Labels: job, lcd tv, move, personal finance

Thursday, October 4, 2007

Options Trading, Part III

Yesterday I wrote about figuring out your comparative advantage. Today, I will discuss where this advantage will be applied.

First, we have to understand why options are valuable. Options have five basic characteristics:

(1) Underlying asset (ie. Google stock)

(2) Type of option, ie. Call or Put

(3) Strike Price - price at which option will be converted

(4) Expiration date - date when contract expires

(5) Volatility - how much periodic movement there is

So now you just have to pick at least two of the five characteristics that you have a comparative advantage in. The more you can be good at, the better your outcome will.

Of course, just because you are good at two of the five, doesn't mean you don't have to either explicitly or implicitly choose all the other five characteristics.

For instance, knowing that Google is going to go up, doesn't mean you can just go out and buy a Call option on Google. You have to consider the current price of Google, and pick a future price you think is obtainable.

The characteristic you can make the most money on is of course strike price. After price will be volatility plays and then duration plays. The last two of course will make you much less money.

Posted by

Finance Guy

at

11:36 PM

0

comments

![]()

Labels: stock market, stock options

Wednesday, October 3, 2007

Options Trading, Part II

The key to any kind of trading is thinking of every trade as a negotiation. When two sides sit down across from each, rather you are the buyer or the seller, both have weaknesses and strengths. Both have reasons they want to participate in the trade, and if you want to make abnormal profits, you need to know why you are capable of making those profits.

Quickly though, let me first explain what abnormal profits are. Abnormal profits are as it the term suggest, profits that are unusual. For example, if you suddenly find gold, you would profit off selling them. But no one will pay you more than the market price for it. That is a normal profit. An abnormal product would be say, gold is going for $100, and normally is costs you $80 to dig up gold, but all of a sudden, you discover a cheap process that finds you gold for $50 and you still sell it for $100.

Abnormal profits occur from having a comparative advantage. If you don't have an advantage, you aren't going to make abnormal profits.

So why do you care to make abnormal profits? Because with the increased riskiness of options, and the sheer amount of extra work you need to put into it, what's the point of getting a 15% return at year end when you could have just bought say the Nasdaq index and just let it sit there for a year for the same return?

I will continue posting for the rest of the week my views on Options Trading. But if you want to profit from what I post, you first have to ask yourself, what comparative advantage do you have over other traders?

Maybe you are smarter, or have a keen analytical sense, or perhaps Greenspan is your next door neighbor. Any of those are fine, but you have to know your advantage so that you can tailor your strategies around it.

[Update] I wanted to add as an incentive to consider your comparative advantage, the difference between me knowing what it was and just playing the market. Last year, I obtained a 10% return over 6 months following classic investing strategies, while this year I have so far obtained a 21% return in the last 2 months (I only started trading again in the last two months).

Posted by

Finance Guy

at

7:34 PM

0

comments

![]()

Labels: options, stock market

Tuesday, October 2, 2007

Options Trading, Part I

Recently, a reader asked a question about how to trade options. I thought about this question, and I realized I needed to explain a lot of background before we can get into the nitty gritty.

First, I do assume you understand what a stock is and the various drivers of stock price.

Second, I assume you have the understanding that investing is inherent risky and options even more so.

Third, I assume you have some fundamental math skills and can use Excel.

Now, rather than explaining what a basic option is, I will link to the Wikipedia article that already explains it pretty well. You only need to read the intro, section 1 and section 6 of the article. The rest is either useless or will be explained by me.

Posted by

Finance Guy

at

12:56 AM

0

comments

![]()

Labels: options

Sunday, September 30, 2007

Networth Update

It's the end of the month, and as I prepare for my move, I need to be more sure than prior months that my finances are together, so that during the frantic atmosphere around a move, nothing falls through the cracks.

It's the end of the month, and as I prepare for my move, I need to be more sure than prior months that my finances are together, so that during the frantic atmosphere around a move, nothing falls through the cracks.

This month has been a great month for me in terms of following my budget. At the end of the month, I was only over by budget by about $2. However, I am still trying to recover my overages from prior months, so I will continue deducting from my discretionary budget.

So compared to last month's networth update, 0.33% increase in my networth, or about $3,300. This is inflated a little bit, since I haven't paid for next month's rent, even including that, my networth has increased by about $1,000.

I am very happy that I am back on track with my finances.

Overall, my networth is -$17,431.62 or about -1.74% away from my goal.

Posted by

Finance Guy

at

9:20 PM

0

comments

![]()

Labels: networth

Friday, September 28, 2007

The week, moving, and reader questions

This has been a hectic week. In my trading, I caught a great dagger in USU last week and made about $1000 from the trade. I thankfully dumped it about 3 hours before it started crashing two days ago.

While I was very excited about this, I also had other things on my mind. Primarily, I have been looking for a new job since I believed I had no real future career at my current position. I resigned this week, and I will write more about this subject over the weekend.

To reader questions who are curious about how I learned to trade and want to learn to trade, I will try to run a series next week.

For now, I need food and drinks or else I will go crazy.

Posted by

Finance Guy

at

4:27 PM

0

comments

![]()

Labels: investment, job, trading, weekend

Monday, September 24, 2007

How to profit off your credit card

I know in the near future, I am going to have a few large expenses. One, I may be moving, and two, I want to get a nice sized LCD for the new place. While I have the money to spent, there are also really nice short-term rates out there in the form of high-yield CDs that many banks are offering.

How do I take advantage of this?

Well, consider that the total expenditures I expect to make are about $5000 (shocking that this is the same amount as the minimum at most banks for said high-yield CD). Instead of spending it, I went out and got a high limit credit card with a 0% APR offer for 6 months.

That way, I can charge the expenses to the credit card, paying the minimum balance to avoid any fees, and since there is no interest involved, by the time I have to pay, the balance would be $5000 - 5 x minimum payments. Considering a minimum payment of 2%, that's about $100 a month. So I would have to pay a lump sum of $4500 by the sixth month.

At the same time as the purchase, I put the $5000 in cash into a 6-month CD at about 5.30% APR. That's about $22 a month in interest, or by the end of 6-months, about $134!

And there you go, if you plan it correctly, you can eat your cake and keep it too!

Posted by

Finance Guy

at

10:01 PM

2

comments

![]()

Labels: CD, credit cards, profit

Thursday, September 20, 2007

-10% to +12% gains in 3 days (that story is in the 3rd paragraph)

There has been a whirlwind of interesting events that have transpired in the last week. Some I can't talk about until I know for sure. But in terms of my finances, and mainly my trading, I can.

Finance-wise, I have been managing to stay within my budget. This has been helped by a combination of seeing the parents more during meal times, and just general life busy-ness preventing me from spending much money. One large upside though was a visit to the casino, which netted me about $400 in extra spending money.

On the trading side, I had been down about 10% on this past Monday. I had hoped for a 25bps decrease in the Fed Fund rate to help out my portfolio, and when a 50bps cut was announced, by portfolio roared back. I started unwinding my portfolio Tuesday, and by yesterday, I was completely out of all my long positions by around 11:30am. Selling had netted be a positive 12% gain on my total investment.

Not bad. And what a relief.

But then I started to think. I knew that the rally had really been artificial, because after all, what does a 50bps rate cut mean? Realistically, nothing much different from 25. Around noon I started buying short positions, and the market started to dip. By the end of the day, by short positions were ahead by about 5%.

The market continued its down slide today, and my shorts are looking better and better. My play here is to sell around the end of the day tomorrow, and then go long again, since I think by Friday, the market well have corrected itself past the Fed cut's temporary boost.

Posted by

Finance Guy

at

7:41 PM

0

comments

![]()

Labels: finance, options, stock market

Tuesday, September 11, 2007

Learning to Trade... the hard way

So the last week of ups and downs have taught me two lessons I really should have known:

- Use bracket orders to set sell points, both at profit-taking and loss-prevention points.

- Gold used to be a hedge against the stock market. Now, it mirrors the stock market.

I now have a pricing rule for my options (using + to indicate profit percent and - to indicate loss percent):

25 cents or less: +40,-25

26-50 cents: +25, -20

51 cents to 150 cents: +15, -10

151 cents or more: +10, -5

If you consider options in general, you will see these price points make sense, as early on, the out of the money options tend to swing a lot and have lower prices. Closer to the money options are also more expensive, but this also prevents huge swings.

(2) I did manage to sell my gold options for a 5% profit, but for a good 3 days, they were down 20%. Why did this happen? I thought perhaps when the market was down, people would rush to a safe commodity, gold. Instead, as a co-worker explained to me, gold has been mirroring the market in recent years because the same money being put into the market is also put into gold. So when investor confidence is low, and the market is tanking, that same money is not being reinvested into gold. Instead, its probably being pulled out of the market altogether.

Posted by

Finance Guy

at

10:37 PM

0

comments

![]()

Labels: investment, stock options, trading

Sunday, September 9, 2007

Networth Outlook

After last week's networth update, I was pondering why I had managed to save nothing last month, and then it hit me. I had waited one day too long to check my bank account, so my rent for this month had been sent out my electronic payment already!

So last month, I actually did save $1000, but it was hard to see it, since I haven't been counting rent paid as an asset. Oh well.

This month I am working hard on keeping my expenses down, and at the very least, within budget. I started this process by writing off $100 of my discretionary budget this month to offset the $520 I have spent over budget this year.

Posted by

Finance Guy

at

10:53 PM

0

comments

![]()

Labels: networth

Wednesday, September 5, 2007

Networth Update

This one is a bit late, but the Labor Day weekend got in the way of regular blogging duties.

This one is a bit late, but the Labor Day weekend got in the way of regular blogging duties.

Comparing to last month, I have gotten a much better grip of my financial situation, staying close to my budget, although I was still off by about $100 by the end of the month. I am accounting for it by decreasing my discretionary budget (ie. entertainment) by $100 for the month of September.

Compared to last month's networth update, I have made a 0.06% increase in my networth by about $500. Unfortunately, this $500 is primarily from a readjustment of my student loans, suggesting that I made no real changes since last month.

This is to be expected though, since I was way over budget last month, and I had to pay the bills this month.

Overall, my net worth is -$20,723.85, making me -2.07% of the way to my goal.

Posted by

Finance Guy

at

12:01 AM

0

comments

![]()

Labels: networth

Saturday, September 1, 2007

"Long"-term market thoughts

It is important to note the difference between a "Trader" and an "Investor". A trader profits in the short-term (a few days), while an investor profits in the long-term (over years). This difference in time necessitates different strategies.

Right now, I am a trader when it comes to my brokerage account, but I have also invested a portion of my salary into a 401(k). When I blog about my accounts ups and downs, I refer to my brokerage account, in which I am short-term.

So as a trader, long-term for me is probably about 2-3 weeks. In that time span, I expect the market indexes to continue pressing upward, spurred on by a Fed Rate cut on Sept. 18th, as well as improving home sales and mortgage environment.

Posted by

Finance Guy

at

7:56 AM

0

comments

![]()

Labels: stock market

Friday, August 31, 2007

Vacation Time

Today was the start of the long weekend, and I took today off just so I can trade options all day. Yyeah, I know its crazy, but I guess I really enjoying doing it.

Anyway, the market hasn't been too volatile, and Bernake's speech along with Bush's speech has calmed the markets.

I've taken two large positions on the S&P500 and Nasdaq Index, betting they will do better in next two months. I expect the Fed Rate will be cut by 25bps, which will propel the market back to its mid-summer highs.

Posted by

Finance Guy

at

1:38 PM

0

comments

![]()

Wednesday, August 29, 2007

Market Changes

On Monday, the Nasdaq started dropping and I sold my September calls for a 105% profit. Then, later in the day, I started buying up October options. As the market continued to dip, I bought more October options today. The hope is that this downward trend will not continue for long

Posted by

Finance Guy

at

12:00 AM

0

comments

![]()

Labels: stock options

Sunday, August 26, 2007

Nearing the end of the month...

And it appears I've going over my budget again. I'm not sure what the issue is. I keep trying to readjust my budget, and I keep being just a little over it. Maybe the trick is to set my budget low so that when I go a little over it, it's actually not too much over?

Aggregating across the last four months, I am about $400 over my budget. Is my saving rate of 10% unrealistic? Should I be spending more/less? Does the 10% even mean anything if that's what I budget for, but I'm always over budget every month?

Posted by

Finance Guy

at

11:40 PM

0

comments

![]()

Labels: budgeting

Tuesday, August 21, 2007

Nasdaq continues upward

The tech index keeps going up, and my options are already in the money. With 30 days left, I forsee it doubling.

This week is going to be my final week of testing the trading platform of my new brokerage. Starting next week, I will be betting more than $400 at a time.

Posted by

Finance Guy

at

10:42 PM

0

comments

![]()

Labels: stock market

Sunday, August 19, 2007

Second Trade

Thursday, I discovered that my brokerage had a mobile trading platform, so that I could keep track of my portfolio at work on my cell phone. Man, that totally helped my day, as I was checking it in between projects, or when I had a brief moment between conference calls.

Now Thursday saw a crazy day for the Nasdaq, as it started the day dropping, and it looked like everything was going into crisis mode. Unfortunately for me, I bought 2 call options on QQQQ, the Nasdaq index ETF, in the morning at $0.90 a contract and saw it drop all morning. By lunch time, I was very worried, but also saw a huge opportunity to lower my cost basis, as the contracts were down to $0.64. I purchased 3 call options at that price, which gave me an average cost basis of $0.80 a contract.

Now, I bought in because I believed Nasdaq will go up by next month, since I didn't think this subprime mess was more than just fearful investors betting on emotions. So come Friday morning, at about 8:10AM, and I was screaming for joy.

I had CNBC on, and they had just announced that the Fed had cut discount window rates by 50 basis points. This immediately caused stock market index futures to spike up across the board, and I knew my contracts were making a profit.

Although the Nadaq see-sawed through-out the day, it ended up, and with my contracts worth $1.13 each. That was easily a $150 profit off of about a $410 investment in a day!

I'm praying the Nikkei does well prior to the market opening, and that I can keep watching the profits roll in.

Posted by

Finance Guy

at

10:53 PM

0

comments

![]()

Labels: nasdaq, stock market

Wednesday, August 15, 2007

First Trade

Today was the first day I could trade so I tried something small to test out the platform. As I have often promoted, I bought Cisco today. But rather than the usual stock buying, I purchases two call options for Cisco ending September '07 at a strike price of $32.50 for $0.45 each.

Options contracts are sold usually in multiples of 100, so buying two contracts really means I purchases 200, or $90 worth. A call option purchase makes money if the underlying stock rises above the strike price by the ending, or expiration, date. In between, the price of the contracts can rise as the underlying stock closes in on the strike price. Also, there is inherent time value of money depending on how far away the expiration date is.

I will talk more about this later, but for now, my roommate is wielding my very nice cutlery in her first attempt to make a fruit bowl out of a watermelon, and I need to make sure she doesn't lose a limb.

Posted by

Finance Guy

at

7:35 PM

0

comments

![]()

Saturday, August 11, 2007

Trading, Not Yet

My brokerage is taking its sweet time setting up my account. They have already received my money but are still requiring me to wait until next Wednesday to begin trading. I'm not sure if its new regulations or what, but it seems unreal that they've got my money and won't let me use it.

Until then, I'm still going to tell you what I would have bought this week: Cisco, Google, and Exxon Mobile. My usual 3 favorites. They have been hit hard this week, and there is no good reason other than market fear. Fundamentally, the three are financially sound.

Posted by

Finance Guy

at

7:09 AM

1 comments

![]()

Labels: stock market

Wednesday, August 8, 2007

Market Volatility

When investors don't know which way the market should be going, it is a terrible time for long-term investors due to the enormous risk, but just an amazing time for traders, as volatility = profits.

For me, as I start to do my "investing", my strategy will be one of trading on volatility. Now, I wouldn't recommend this as the only investment strategy for the long-term. I have my own safer long-term investments.

But, since I'm not worried about my financial future, I am investing my excess cash into short-term trading and speculation.

I will be reporting my gains and loses and thoughts here.

Posted by

Finance Guy

at

10:04 PM

0

comments

![]()

Sunday, August 5, 2007

Stabilizing Cash Flows

This month begins my attempt at stabilizing my cash flows. Now that I'm moved out, and I have an idea what the increase in food and utility costs are, I've reworked my budget so that no longer is my excuse "It'll get better when its not a 'special' month."

In terms of costs, I have increased rent costs of $1175 (not he full $1275, since I was paying my parents a nominal $100 a month), increased food costs of $125, and obviously new utility costs of $120.

This obviously puts a dampener on my ability to save up money.

Maybe I'll have to increase my gambling trips... :-)

Posted by

Finance Guy

at

9:23 PM

0

comments

![]()

Friday, August 3, 2007

Birthday!

August 2nd was my birthday, and I spent it sitting in my room playing with my computer.

No, it's not because people don't like me, but it had been a long week and I really just needed time on my own.

Anyway, things are looking up in my word. I'm going to start trading (stocks, options) again! I can't wait to be back in the swing of things.

Posted by

Finance Guy

at

12:48 AM

1 comments

![]()

Labels: birthday

Tuesday, July 31, 2007

Networth Update

I have dreaded this day for the past week, realizing that today would be the day all my crazy spending will really strike home.

I have dreaded this day for the past week, realizing that today would be the day all my crazy spending will really strike home.

Although certainly the month had circumstances that are abnormal, ie. moving into a new apartment and having to buy a new computer, it nevertheless is just an excuse for the spending, rather than a financially responsible situation.

Compared to last month's networth update, I have made a 0.12% decline, decreasing my networth by $1,200. $500 still continues to be tied up in my student loans, as my new lender has not received the refund from my old lender for paying too much yet (and I may have lost this $500 if it weren't for the fact that blogging made me remember).

My networth is -$21,251.37 or -2.13% of the way to my million dollar goal.

Posted by

Finance Guy

at

9:59 PM

2

comments

![]()

Labels: networth

Monday, July 30, 2007

Stocks on my mind

After a week of tumbling stocks last week, and a huge gain for the market today, I think its a good time to recommend to the world the stocks I've been thinking about.

Typically, my top 3 choices are Apple (APPL), Google (GOOG), and Exxon Mobile (XOM). This week it's no different.

Why do I pick these 3 stocks consistently when I talk to my family and friends? Because these three company continue to amaze me.

And this week especially, I recommend these stocks because two of the three (Google and Exxon) missed earnings expectations, making them especially juicy buys after the initial dip in their stock prices.

Let's start with Apple. With all the hype of iPhone, and the continued success of the iPod, it shouldn't be hard to see the media attention Apple gets. But, with initial reports that the iPhone sales were below analyst expectations, the market was worried, until they heard about the "sweet deal" AT&T gave Apple (story here). AT&T is not only subsidizing the cost of the iPhone, but Apple is picking up monthly residuals on each subscriber, each $9 a month per user. Apple may be an one-product company now, but when that product is so huge, it doesn't really matter.

Speaking of one-product companies, Google is another one of those technological wonders that has succeeded off the back of one good product, their search engine. However, they too felt a huge hit to their stock price when their quarterly reports missed analysts expectations. But the stock has been creeping back slowly. Why? Because a further analysis of the 10 cent miss, and according to their CEO Eric Schmidt (story here), shows that a majority of the miss is attributable to a 10% increase in headcount and a shoring up of their accounting procedures. For a large stable company, such a hiring bonanza is cause for worry, but for a growth company, such an increase is akin to buying a larger factory or any other asset. Sure it costs money now, but eventually, they'll figure out how to turn that expense into profit.

On to Exxon Mobil. I don't need too much of an explanation. With continued high profits and soaring crude oil prices, who wouldn't think a gas company is a great (long-term) buy?

Posted by

Finance Guy

at

10:33 PM

0

comments

![]()

Labels: apple, exxon, google, stock market, stocks

One day away...

Judgment day is upon me, or at the very least, month-end reconciliation is coming, and I fear the damage.

Posted by

Finance Guy

at

12:26 AM

0

comments

![]()

Friday, July 27, 2007

Simpsons Movie is AWESOME!

For fans of the show, the entire movie is about knowing the characters and understanding the references. For those who have never seen the show, you will be disappointed the first time, but if you watch the show for a bit and then watch the movie again, it'll be a whole lot funnier.

I can't wait to see it again tomorrow (Friday night, since it's still Thursday for me until I go to sleep.

Posted by

Finance Guy

at

1:15 AM

0

comments

![]()

Wednesday, July 25, 2007

CFA Level I Results are in

And I, along with 60% of the other test takers, did not pass CFA Level I's. Like the OWL's of Harry Potter, I won't be moving on to the next level until I can pass this one.

Honestly, I saw this coming, as I didn't really spend as much time as I should have studying all the material, figuring my MBA studies were enough. Not until later, did I realize how true the saying, "MBA is a mile wide in business and an inch deep in finance, and CFA is a mile deep in finance and an inch wide in business."

Looking at the breakdown of the section, the parts I was good at was ethics, economics and quantitative analysis. Other aspects, such as portfolio management and alternative assets, I did not do as well in.

I'm just going to have to hunker down and study hard for the December one.

Posted by

Finance Guy

at

9:56 PM

0

comments

![]()

Monday, July 23, 2007

Back

Finally, things have settled down for me. I'm fully moved into my apartment, I have furniture, I have cable, and work hasn't been as hectic since quarter close.

Since then, I know I've skipped a lot of opportunities to blog, and I really need to get back into the swing things.

One of the biggest financial differences (other than paying rent) I have noticed is that I am spending way too much on food. I never really tried to quantify how much it costs to buy and cook food, but considering by typical $10 lunches and $15 dinners, that's adding up way past what I had originally budgeted for food, $400 a month.

I have to seriously reconsider by eating habits, and definitely start cooking for myself again. Although back in grad school, I did cook for myself, my time constraints were a bit different. For one, I wasn't actually exhausted at the end of the day. Second, I didn't have to worry about having enough time to both cook and eat.

This increased expense has me worried. For now, I tell myself it's a temporary increase in expenses, but I need to start clamping down on that by next week.

Also, it's getting to the end of the month, ever closer to updating my networth, and frankly, I'm a bit scared to do it.

Posted by

Finance Guy

at

9:59 PM

2

comments

![]()

Labels: apartment, networth, personal finance

Friday, July 20, 2007

Alive, but working hard

SO I haven't been able to find much time to post. I have settled in, and this week at work has been rough. More posts to come this weekend.

Posted by

Finance Guy

at

1:26 AM

0

comments

![]()

Sunday, July 15, 2007

Moved in, but without internet...

For the last few days, I have been in the process of moving into my apartment. It was a bit rough, as I had to deal with the world's slowest elevator and intermittent shutdowns of the elevator for maintenance and other people's move-ins.

On top of that, my desktop computer did not survive 3 months in my basement, forcing me to go out and buy a new one. That was a fun $900 unplanned expense.

Yesterday, I also waited about 7 hours for the cable guy to show. They promised me they would show up between 2-5, and ended showing at 9:15. The guy played around with the cables for an hour and told me that he couldn't get cable to work, so no tv or internet.

Great.

So I can look forward to wasting more time another day.

In the mean time, I think I'm stealing wireless internet from my concierge's unsecured router.

Posted by

Finance Guy

at

5:17 PM

0

comments

![]()

Labels: apartment

Thursday, July 12, 2007

Continued good news on furniture

Turns out, the sales people were in a huge rush last night, and when they audited their orders this morning, they realized that I had created a bundle package, and so were able to give me $105 off my price!

That's just amazing customer service. So to the sales reps of Bob's Discount Furniture, well done!

Also, I officially signed my lease documents, cut the checks, and received my apartment keys.

I'm all set for my Friday morning move in.

Posted by

Finance Guy

at

12:10 AM

1 comments

![]()

Tuesday, July 10, 2007